Long Trade Idea

Enter your long position between $231.75 (the intra-day high of its last bearish candlestick) and $234.60 (the intra-day high before its breakdown below its Fibonacci Retracement Fan).

Market Index Analysis

- Amazon.com (AMZN) is a member of the NASDAQ 100, the Dow Jones Industrial Average, the S&P 100, and the S&P 500.

- All four indices are approaching all-time highs with lower volumes, and the sell-off conditions remain intact.

- The Bull Bear Power Indicator of the NASDAQ 100 turned bullish, but below its descending trendline.

Market Sentiment Analysis

Equity markets recovered most of their losses, but trading volumes decreased, and do not confirm the uptrend. Opinions about the much-awaited Santa Claus rally differ, as the conditions leading to last month’s sell-off remain. The AI bubble expands amid circular financing and valuations. Consumer sentiment remains a concern, and inflation is sticky as growth is slowing. China’s manufacturing sector unexpectedly contracted, and equity futures point to a severe sell-off at the beginning of December.

Amazon.com Fundamental Analysis

Amazon.com is one of the Big Five US technology companies and a leader in the global AI race and cloud computing sector. It has excellent profit margins, but its debt remains excessive. AMZN is an industry disruptor but faces stiff competition from China.

So, why am I bullish on AMZN following its breakout?

The latest announcement to integrate Deepgram, the most realistic and real-time Voice AI platform, enterprise-grade speech-to-text (STT) and text-to-speech (TTS) models with Amazon Connect and Amazon Lex, further expands the overall competitiveness of the AWS environment. It follows the launch of its private-label grocery store, its recent partnership with WeightWatchers to deliver medication, and its diversification of revenue streams to fund its AI and e-commerce business.

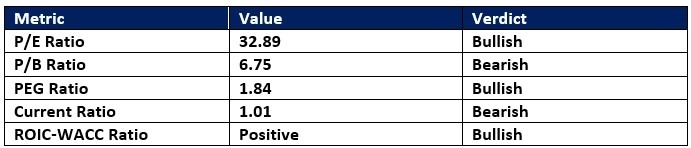

Amazon.com Fundamental Analysis Snapshot

The price-to-earning (P/E) ratio of 32.89 makes AMZN a reasonably priced stock. By comparison, the P/E ratio for the NASDAQ 100 is 34.89.

The average analyst price target for AMZN is $294.65. It suggests good upside potential with manageable downside risks.

Amazon.com Technical Analysis

Today’s AMZN Signal

Amazon Price Chart

- The AMZN D1 chart shows price action breaking out above a horizontal support zone.

- It also shows price action below its ascending Fibonacci Retracement Fan with enough bullish momentum for a break-in.

- The Bull Bear Power Indicator turned bullish with an ascending trendline.

- The average bullish trading volumes are higher than the bearish trading volumes over the past week.

- AMZN did not accelerate as fast as the NASDAQ 100 Index, a bearish development, but bullish momentum remains strong.

My Call on Amazon.com

I am taking a long position in AMZN between $231.75 and $234.60. AMZN remains a leader in AI, cloud computing, and e-commerce, and its current valuation trades well below its five-year average, with excellent upside potential.

Top Regulated Brokers

- AMZN Entry Level: Between $231.75 and $234.60

- AMZN Take Profit: Between $289.05 and $294.65

- AMZN Stop Loss: Between $207.31 and $215.18

- Risk/Reward Ratio: 2.35

Ready to trade our analysis of Amazon.com? Here is our list of the best stock brokers worth reviewing.