Short Trade Idea

Enter your short position between $369.26 (the lower band of its horizontal resistance level) and $387.49 (the upper band of its horizontal resistance level).

Market Index Analysis

- American Express (AXP) is a member of the Dow Jones Industrial Average, the S&P 100, and the S&P 500.

- The S&P 500 broke down below its horizontal resistance zone with rising bearish momentum.

- The Bull Bear Power Indicator of the S&P 500 turned bearish with a descending trendline.

Market Sentiment Analysis

Equity markets extended their sell-off yesterday, led by AI-related tech stocks, after Oracle lost a financial backer for a $10 billion data center project. Equity futures are mixed this morning, after Micron earnings blew past expectations and shares rose over 10% in after-market trading. Markets will also receive October’s CPI report, where analysts expect the core CPI to increase to 3.1% annualized. Expectations for a January interest rate cut are roughly 25%, but the CPI report can inject volatility into today’s session.

American Express Fundamental Analysis

American Express is the world’s fourth-largest card network based on purchase volume. It generally caters to more affluent consumers, and it is well-known for its rewards, exclusive offers, and partnership programs.

So, why am I bearish on AXP after its 25%+ rally?

I remain bearish amid a fragile balance sheet, led by a worsening debt-to-asset ratio, and the push into lower-quality sectors, driven by its BNPL push, which I see as brand-damaging and a move away from its core consumer group that helped it stand out among other credit card issuers. I see no upside catalysts ahead.

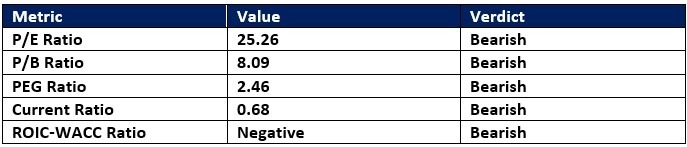

American Express Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 25.26 makes AXP an expensive stock relative to its peers. By comparison, the P/E ratio for the S&P 500 is $28.88.

The average analyst price target for AXP is $363.05. It suggests no upside potential with expanding downside risks.

American Express Technical Analysis

Today’s AXP Signal

American Express Price Chart

- The AXP D1 chart shows price action inside a horizontal resistance zone.

- It also shows price action between its ascending 0.0% and 38.2% Fibonacci Retracement Fan levels.

- The Bull Bear Power Indicator is bullish with a descending trendline, approaching a bearish crossover.

- The average bearish trading volumes are higher than the average bullish trading volumes.

- AXP corrected less than the S&P 500, a lone bullish development, but bearish momentum is accelerating.

Top Regulated Brokers

My Call on American Express

I am taking a short position in AXP between $369.26 and $387.49. The fragile balance sheet, rising debt, and brand value destruction via the BNPL push fortify my bearish stance.

- AXP Entry Level: Between $369.26 and $387.49

- AXP Take Profit: Between $302.51 and $309.81

- AXP Stop Loss: Between $399.12 and $407.10

- Risk/Reward Ratio: 2.24

Ready to trade our analysis of American Express? Here is our list of the best stock brokers worth reviewing.