Short Trade Idea

Enter your short position between $275.43 (the intra-day high of its last bearish candlestick) and $280.38 (last week’s intra-day high).

Market Index Analysis

- Apple (AAPL) is a member of the NASDAQ 100, the Dow Jones Industrial Average, the S&P 100, and the S&P 500.

- All four indices are approaching all-time highs with lower volumes, and the sell-off conditions remain intact.

- The Bull Bear Power Indicator of the NASDAQ 100 Index turned bullish, but below its descending trendline.

Market Sentiment Analysis

Equity markets recovered most of their losses, but trading volumes decreased, and do not confirm the uptrend. Opinions about the much-awaited Santa Claus rally differ, as the conditions leading to last month’s sell-off remain. The AI bubble expands amid circular financing and valuations. Consumer sentiment remains a concern, and inflation is sticky as growth is slowing. China’s manufacturing sector unexpectedly contracted, and equity futures point to a severe sell-off at the beginning of December.

Apple Fundamental Analysis

Apple is the largest tech company by revenue and the third-largest company by market capitalization. It is at the core of the US tech industry, but it is missing out on several disruptive trends. Still, it has high brand loyalty and a massive following.

So, why am I bearish on AAPL despite its recent advance?

While the iPhone 17 launch was stellar and on track to make Apple the largest smartphone manufacturer for the first time since 2011, I see nothing beyond this one-time event. Apple’s growth rate is declining, valuations are excessive, and it has no clear AI strategy. The competition with Samsung will heat up, and I see margin pressures ahead for Apple as it adjusts its supply chain and maintains its iPhone 17 price.

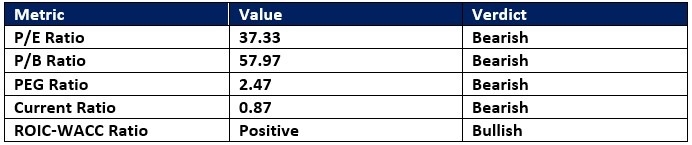

Apple Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 37.33 makes AAPL an expensive stock. By comparison, the P/E ratio for the NASDAQ 100 is 34.89.

The average analyst price target for AAPL is $281.75. This suggests no upside potential with rising downside risks.

Apple Technical Analysis

Today’s AAPL Signal

Apple Price Chart

- The AAPL D1 chart shows a price action inside a horizontal resistance zone.

- It also shows price action between its ascending 0.0% and 38.2% Fibonacci Retracement Fan levels.

- The Bull Bear Power Indicator is bullish with a negative divergence.

- The average bearish trading volumes are higher than the average bullish trading volumes.

- AAPL advanced with the NASDAQ 100 Index, a bullish confirmation, but bearish catalysts have increased.

My Call on Apple

I am taking a short position in AAPL between $275.43 and $280.38. I am selling Apple at current valuations, as I see no bullish catalyst. I am also worried about margin pressures, as input costs for the iPhone 17 were higher than for the iPhone 16, yet selling prices remained identical.

- AAPL Entry Level: Between $275.43 and $280.38

- AAPL Take Profit: Between $234.51 and $244.00

- AAPL Stop Loss: Between $294.40 and $303.23

- Risk/Reward Ratio: 2.16

Ready to trade our analysis of Apple? Here is our list of the best stock brokers worth reviewing.