What are Nuclear Energy Stocks?

Nuclear energy stocks are publicly listed companies active in the nuclear energy sector. They primarily operate nuclear reactors to generate electricity. Alternatively, investors can participate in nuclear energy through uranium mining stocks.

Why Should You Consider Investing in Nuclear Energy Stocks?

Nuclear energy is a cornerstone of clean energy, and small modular reactors (SMRs) represent the industry’s most significant breakthrough. They can address the tremendous energy demand posed by data centers and AI. Forecasts estimate nuclear energy investment to exceed $2 trillion by 2050. With energy needs rising, energy security a national security concern for most countries, and the need to lower carbon emissions, nuclear energy has a bright future.

Here are a few things to consider when evaluating nuclear energy stocks:

Invest in nuclear energy stocks that have signed deals with some of the most notable end-users like tech giants Meta Platforms, Microsoft, Amazon, and Alphabet.

Analyze next-generation nuclear energy stocks that can power the future with disruptive technologies, including nuclear fusion reactors.

Mix your nuclear energy portfolio with established nuclear energy stocks, uranium miners, and next-generation players to diversify your exposure.

What are the Downsides of Nuclear Energy Stocks?

Uranium miners may struggle to meet demand, and uranium prices are volatile. Despite its clean energy appeal, opponents will try to derail or limit its potential due to concerns about nuclear waste and its environmental impact, which pose significant storage challenges. Nuclear energy experienced three major catastrophes: Chernobyl (1986), Three Mile Island (1979), and Fukushima (2011). Therefore, push back against new nuclear reactors could delay deployment.

Here is a shortlist of currently attractive nuclear energy stocks:

- Centrus Energy (LEU)

- Public Service Enterprise Group (PEG)

- Honeywell International (HON)

- BWX Technologies (BWXT)

- GE Vernova (GEV)

Update on My Previous Best Nuclear Energy Stocks to Buy Now

In our previous installment, I highlighted the upside potential of Centrus Energy and Public Service Enterprise Group.

Centrus Energy (LEU) - A long position in LEU between $246.00 and $269.00

LEU advanced by over 8% and I maintain my long position after it broke out above its horizontal support level.

Public Service Enterprise Group (PEG) - A long position in PEG between $81.25 and $82.91

PEG inched up by nearly 2% and bounced off its horizontal support zone. I expect more upside and leave my position unchanged.

Honeywell International Fundamental Analysis

Honeywell International (HON) is a conglomerate with aerospace, building automation, industrial automation, and energy and sustainability solutions (ESS) at its core. Additionally, it operates Sandia National Laboratories and has a global workforce of over 100,000 employees. It is also a member of the Dow Jones Industrial Average, NASDAQ 100, the S&P 100, and the S&P 500.

So, why am I bullish on HON after its post-earnings slide?

I am bullish on its Aerospace Technologies and Energy and Sustainability Solutions. Investors gain exposure to the nuclear energy sector through one of the best-diversified manufacturing companies, and HON operates four sites for the US Department of Energy (DOE) and the National Nuclear Security Administration (NNSA). Its indirect exposure to nuclear energy makes it necessary to counter the more volatile direct exposure to the sector.

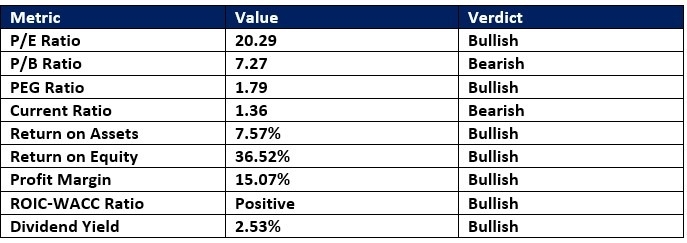

Honeywell International Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 20.29 makes HON an inexpensive stock. By comparison, the P/E ratio for the S&P 500 is 30.61.

The average analyst price target for HON is $241.67. This suggests excellent upside potential with limited downside risks.

Honeywell International Technical Analysis

Honeywell International Price Chart

- The HON D1 chart shows price action between its descending 0.0% and 38.2% Fibonacci Retracement Fan levels.

- It also shows Honeywell International inside its horizontal support zone.

- The Bull Bear Power Indicator is bearish with an ascending trendline, slowly approaching a bullish crossover.

My Call on Honeywell International

I am taking a long position in HON between $186.76 and $192.55. The industry-leading profit margin, well-diversified operations, and low valuations solidify my bullish case.

- HON Entry Level: Between $186.76 and $192.55

- HON Take Profit: Between $227.74 and $241.67

- HON Stop Loss: Between $168.55 and $177.42

- Risk/Reward Ratio: 2.25

BWX Technologies Fundamental Analysis

BWX Technologies (BWXT) is a manufacturing company that supplies nuclear components and fuel. BWXT operates via BWXT mPower, BWXT Nuclear Energy, BWXT Nuclear Operations Group, and BWXT Technical Services Group. It is also a member of the S&P 400.

So, why am I bullish on BWXT after its breakout?

Unlike most nuclear energy stocks, BWX Technologies has massive government contracts as the leading supplier of reactors for US Navy submarines and aircraft carriers. Its 2025 acquisition of Kinectrics enhanced its position in commercial nuclear reactors and nuclear medicine. It is also a core player in small modular nuclear reactors (SMRs), and I am bullish on its long-term growth prospects, as its specialization grants it a competitive edge.

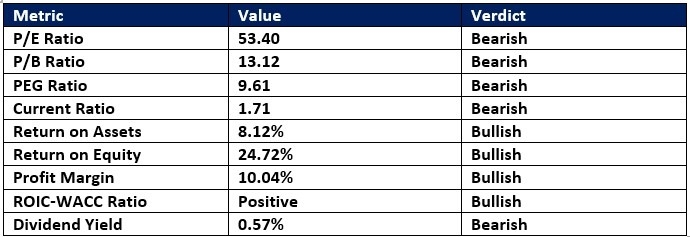

BWX Technologies Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 53.40 makes BWXT an expensive stock. By comparison, the P/E ratio for the S&P 500 is 30.61.

The average analyst price target for BWX Technologies is $216.40. It suggests excellent upside potential with manageable downside risks.

BWX Technologies Technical Analysis

BWX Technologies Price Chart

- The BWXT D1 chart shows price action breaking out above its ascending 61.8% Fibonacci Retracement Fan level.

- It also shows BWX Technologies breaking out above its horizontal support zone.

- The Bull Bear Power Indicator is bearish with an ascending trendline and approaches a bullish crossover.

My Call on BWX Technologies

I am taking a long position in BWX Technologies between $172.41 and $182.88. While valuations are high, I remain bullish on its defense-related nuclear programs.

- BWXT Entry Level: Between $172.41 and $182.88

- BWXT Take Profit: Between $218.50 and $229.43

- BWXT Stop Loss: Between $149.57 and $154.78

- Risk/Reward Ratio: 2.02

Ready to trade our analysis of the best nuclear energy stocks? Here is our list of the best stock brokers worth reviewing.