The biotech sector remains poised for massive breakthroughs and advancements, driven by the rise of AI-assisted research, which is speeding up the discovery of potential treatments. Biotech companies are working on finding life-saving cures and treatments, as well as innovative methods to prevent their spread or manifestation in patients.

What are Biotech Stocks?

Biotech stocks refer to publicly listed companies that research and develop life-saving cures and treatments. They drive medical innovation, develop often-unimaginable therapies through in-depth specialization, develop custom-tailored medicines for individuals, and revolutionize healthcare. Biotech stocks can improve longevity and present investors with excellent long-term growth potential.

Why Should You Consider Buying Biotech Stocks?

While it took years or decades for biotech stocks to bring a product to market, advances in AI-assisted research using supercomputers have sped up the discovery and development of novel therapies and medicines. Rapid innovation creates an exciting investment landscape for patient investors. Projections call for the biotech sector to reach $3.9 trillion by the end of the decade and to swell to $8 trillion by 2035.

Here are a few things to consider when evaluating biotech stocks:

- Biotech stocks are often high-risk, high-reward stocks.

- Technological innovation, led by advancements in AI, makes the biotech sector highly attractive.

- Investors should focus on biotech stocks with an existing, revenue-generating product and a healthy pipeline of late-phase trials.

- Favor biotech stocks with substantial cash balances, as research and development costs are extreme.

- Create a separate biotech portfolio and consider mixing well-established biotech stocks with small-cap biotech stocks.

What are the Downsides of Biotech Stocks?

Biotech stocks move aggressively on the release of study data and depend on approvals from drug regulators. Therefore, investors must accept volatility. Competition remains stiff, and capital-intensive research and development favors cash-rich companies. Biotech companies often raise fresh capital by issuing new shares, diluting existing shareholders, or through debt. Regrettably, fraud is also part of the biotech sector.

Here is a shortlist of biotech stocks to consider:

- BioMarin Pharmaceutical (BMRN)

- Exelixis (EXEL)

- Tyra Biosciences (TYRA)

- Fortrea Holdings (FTRE)

- Ascendis Pharma A/S (ASND)

- Regeneron Pharmaceuticals (REGN)

- GH Research (GHRS)

BioMarin Pharmaceutical Fundamental Analysis

BioMarin Pharmaceutical (BMRN) is a biotechnology company focused on enzyme replacement therapies (ERTs). It was the first company to provide treatment for mucopolysaccharidosis type I (MPS I) and phenylketonuria (PKU). BMRN is also a member of the S&P 400.

So, why am I bullish on BMRN following its latest earnings report?

BioMarin Pharmaceutical has six marketed therapies, and I am bullish on its rare genetic-disease therapeutics portfolio. BMRN has a deep in-house pipeline, and I appreciate its strategic acquisitions. Given its specialization, BioMarin Pharmaceutical benefits from pricing power while generating free cash flow from treatments for PKU. Long-term revenue growth is accelerating, and BMRN has launched promising therapies over the past three years with unrealized potential.

BioMarin Pharmaceutical Fundamental Analysis Snapshot

The price-to-earning (P/E) ratio of 20.79 makes BMRN an inexpensive stock. By comparison, the P/E ratio for the S&P 500 is 30.61.

The average analyst price target for BioMarin Pharmaceutical is $89.36. This suggests excellent upside potential with falling downside risks.

BioMarin Pharmaceutical Technical Analysis

BioMarin Price Chart

- The BMRN D1 chart shows price action between its descending 38.2% and 50.0% Fibonacci Retracement Fan levels, with a pending breakout.

- It also shows BioMarin Pharmaceutical inside a bullish price channel.

- The Bull Bear Power Indicator is bullish with an ascending trendline.

My Call on BioMarin Pharmaceutical

I am taking a long position in BMRN between $54.51 and $56.45. BioMarin Pharmaceutical has an impressive in-house pipeline, six marketed therapies, and strong operational metrics, yet its valuation is low.

- BMRN Entry Level: Between $54.51 and $56.45

- BMRN Take Profit: Between $73.51 and $78.00

- BMRN Stop Loss: Between $46.84 and $49.31

- Risk/Reward Ratio: 2.48

Exelixis Fundamental Analysis

Exelixis (EXEL) is a biotech company developing the FDA-approved treatment Cometriq for medullary thyroid cancer, Cabozantinib for advanced renal cell carcinoma and other cancers, and Cobimetinib in combination with Vemurafenib for certain types of melanoma. EXEL is also a member of the S&P 400.

So, why am I bullish on EXEL despite its 33%+ rally since late October?

I am bullish on its massive jump in profit margins, up from 17.4% last year to 27.0% this year. Higher product sales, lower collaboration revenues, and a healthy pipeline provide bullish catalysts. EXEL experienced an impressive 50% growth in Cabometyx sales for neuroendocrine tumors, while positive trial data from Zanzalintinib in combination with immune checkpoint inhibitors is a promising future revenue catalyst.

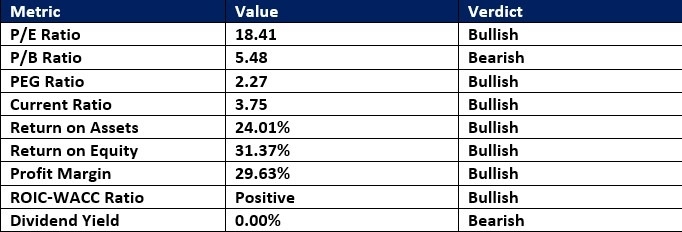

Exelixis Fundamental Analysis Snapshot

The price-to-earning (P/E) ratio of 18.41 makes EXEL an inexpensive stock. By comparison, the P/E ratio for the S&P 500 is 30.61.

The average analyst price target for Exelixis is $45.00. While this suggests no upside potential, I consider it too conservative, while downside risks are acceptable.

Exelixis Technical Analysis

Exelixis Price Chart

- The EXEL D1 chart shows price action between its ascending 0.0% and 38.2% Fibonacci Retracement Fan levels with a pending breakout.

- It also shows Exelixis inside a bullish price channel.

- The Bull Bear Power Indicator is bullish, but a negative divergence has formed.

Top Regulated Brokers

My Call on Exelixis

I am taking a long position in EXEL between $42.96 and $44.91. I am bullish on the growth rate of existing therapies, encouraging trial results for its potentially subsequent blockbuster treatment, and superb operational metrics, including low valuations.

- EXEL Entry Level: Between $42.96 and $44.91

- EXEL Take Profit: Between $58.59 and $60.93

- EXEL Stop Loss: Between $36.00 and $39.83

- Risk/Reward Ratio: 2.25

Ready to trade our analysis of the best biotech stocks? Here is our list of the best stock brokers worth checking out.