The emergence of AI has driven demand for data center stocks, ushering in a new technological revolution.

What are Data Center Stocks?

Data center stocks refer to publicly listed companies that are actively involved in building and operating data centers. These companies are active in construction, power generation, thermal management, and data center operations. There are power-hungry, massive, warehouse-like buildings that house servers and related technology powering AI, the internet, and everything in the cloud.

Why Should You Consider Investing in Data Center Stocks?

Data centers are not a new investment phenomenon, as the internet requires them to operate. The breakthrough in AI adoption in 2022 created a demand boost, as hyper-scalers require massive data centers for AI-related operations. The data center market is on track to exceed $600 billion by the end of 2030, as part of the multi-trillion AI sector, with annualized double-digit growth rates.

Here are a few things to consider when evaluating data center stocks:

- Focus on data center stocks with revenue growth over the past three years.

- Diversify your data center portfolio with companies that construct data centers, provide thermal management, and server components.

- Mix your data center stock portfolio with companies involved in electricity generation.

- Analyze the balance sheet and avoid high-debt data center stocks.

- Check the Power Utilization Effectiveness (PUE), a core indicator of how efficiently the data center operates, together with occupancy rates

What are the Downsides of Data Center Stocks?

The data center segment is highly competitive and requires massive capital expenditures to ensure servers run with the most cutting-edge technology. Energy availability is another significant factor, with some hyper-scalers preferring co-location rather than relying on the energy provider. The recent AI hype has spiked valuations, which is adding to downside risks. The AI boom will eventually slow down, technological breakthroughs could result in lower data center demand than currently planned, and rising electricity costs could threaten capital expenditure plans.

Here is a shortlist of data center stocks to consider for 2026:

- Nebius Group (NBIS)

- Johnson Controls International (JCI)

- Fabrinet (FN)

- Applied Digital Corporation (APLD)

- Core Scientific (CORZ)

Update on My Previous Best Data Center Stocks Item

Previously, I highlighted the upside potential of TE Connectivity and Corning.

TE Connectivity (TEL) - A long position in TEL between $224.18 and $227.64

TEL rallied nearly 12% before reversing, but my stop loss at $237.00 triggered, resulting in a profit just shy of 7%. I will re-enter this trade in the same entry zone.

Corning (GLW) - A long position in GLW between $82.82 and $84.59

GLW jumped nearly 13% before it followed the rest of the sector lower. My stop-loss hit at $82.00, resulting in a profit close to 11%.

Nebius Group Fundamental Analysis

Nebius Group (NBIS) operates servers and data centers (one in Finland with one under construction in the US), and cloud infrastructure for AI developers (a GPU cluster in Paris, and one under construction in the US). It also owns Avride and TripleTen and holds equity stakes in Toloka and ClickHouse.

So, why am I bullish on NBIS following its 47% plunge?

The sell-off created an excellent long-term buying opportunity, and I remain bullish after Nebius Group signed a multi-year $19 billion AI infrastructure agreement with Microsoft. It also launched Nebius AI Cloud 3.1, its next-gen cloud offering to lower barriers for AI developers.

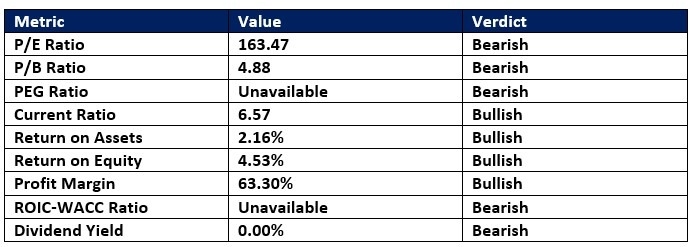

Nebius Group Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 163.47 makes NBIS an expensive stock. By comparison, the P/E ratio for the S&P 500 is 29.01.

The average analyst price target for Nebius Group is $151.50. This suggests excellent upside potential with manageable downside risks.

Nebius Group Technical Analysis

Nebius Group Price Chart

- The NBIS D1 chart shows price action breaking out above its descending 50.0% Fibonacci Retracement Fan level.

- It also shows Nebius Group breaking out above a horizontal support zone.

- The Bull Bear Power Indicator turned bullish with an ascending trendline.

My Call on Nebius Group

I am taking a long position in NBIS between $86.20 and $93.23. While valuations are high, it has an excellent capital position, industry-leading profit margins, and superb upside potential.

- NBIS Entry Level: Between $86.20 and $93.23

- NBIS Take Profit: Between $134.93 and $141.10

- NBIS Stop Loss: Between $70.54 and $75.96

- Risk/Reward Ratio: 3.12

Applied Digital Fundamental Analysis

Applied Digital (APLD) designs, develops, and operates digital infrastructure solutions. It focuses on high-performance computing (HPC) and artificial intelligence industries via its two business segments: Data Center Hosting Business and HPC Hosting Business. It also offers infrastructure services to crypto miners.

So, why am I bullish on APLD despite its challenging operational metrics?

I am bullish on Applied Digital on its transition from crypto miners to hyperscalers and AI firms, as evident by its recent lease agreement with CoreWeave for an additional 150MW at its Polaris Forge 1 Campus, and its $100 million financing to develop a data center. I am equally bullish about its focus on liquid-cooled infrastructure.

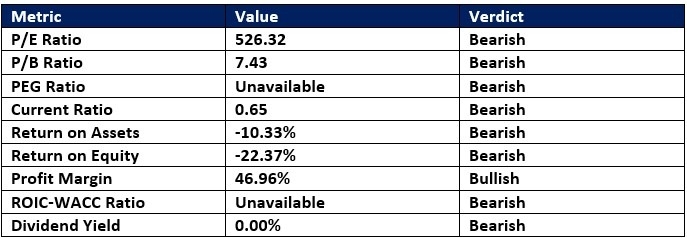

Applied Digital Fundamental Analysis Snapshot

The forward price-to-earnings (P/E) ratio of 526.32 makes APLD an expensive stock. By comparison, the P/E ratio for the S&P 500 is 29.01.

The average analyst price target for Applied Digital is $43.70. This suggests excellent upside potential with acceptable downside risks.

Applied Digital Technical Analysis

Applied Digital Price Chart

- The APLD D1 chart shows price action breaking out above its descending Fibonacci Retracement Fan.

- It also shows Applied Digital inside a bullish price channel.

- The Bull Bear Power Indicator turned bullish with an ascending trendline.

My Call on Applied Digital

I am taking a long position in APLD between $26.86 and $29.46. APLD continues to take the necessary steps to boost revenues, and I see massive improvements ahead, led by expected annualized EPS growth above 30%.

- APLD Entry Level: Between $26.86 and $29.46

- APLD Take Profit: Between $43.70 and $45.89

- APLD Stop Loss: Between $19.01 and $20.89

- Risk/Reward Ratio: 2.15

Ready to trade our analysis of the best data center stocks? Here is our list of the best stock brokers worth reviewing.