Defense stocks are highly popular among professional portfolios because they can protect the bottom line, as their name suggests. The primary customers of defense stocks are governments, which bring steady, long-term contracts, deep pockets, and a history of paying their bills on time.

What are War Stocks?

War stocks, also known as defense stocks, refer to publicly listed companies that are actively engaged in the aerospace, space, and defense sectors. They form the backbone of defending sovereign countries and territories. Analysts expect demand to surge over the next decade amid rising global conflicts and geopolitical tensions.

Why Should You Consider Investing in Defense Stocks?

Defense stocks provide long-term, reliable income streams for companies. They outperform during market corrections and bear markets, as short-term economic cycles have a minimal impact on their business model.

Despite popular opinion, conflicts do not move the price of defense stocks. There will be a short-term bounce, which usually falters. Investors must understand the long-term nature of defense stocks, where research and development (R&D) remain crucial. Conflicts boost demand for replenishing stockpiles and hardware, create opportunities to test new weapons platforms, and attract future buyers. Still, R&D and cybersecurity services are where defense stocks receive their best margins.

Here are a few things to consider when evaluating defense stocks:

- The defense sector is seeking green alternatives, and stocks with a lead in sustainability could outperform peers.

- Focus on defense stocks with excellent R&D capabilities.

- Communications, electronic warfare, and cybersecurity defense stocks provide ongoing revenue and have excellent growth rates.

- Defense stocks active in drone and anti-drone warfare rank among the fastest-growing defense companies.

What are the Downsides of Defense Stocks?

The biggest downside is the change in government defense spending. It can have a material impact on defense stocks, but developments over the past three years have nearly eliminated this risk.

Morally, you may not feel comfortable investing in weaponry which could be used in circumstances you disapprove of.

Here is a shortlist of attractive defense stocks:

- Teledyne Technologies (TDY)

- Axon Enterprise (AXON)

- L3Harris Technologies (LHX)

- RTX Corporation (RTX)

- Northrop Grumman (NOC)

- General Dynamics (GD)

- Lockheed Martin (LMT)

- Leidos Holdings (LDOS)

- Curtiss-Wright (CW)

L3Harris Technologies Fundamental Analysis

L3Harris Technologies (LHX) is a technology company, defense contractor, and information technology services provider that produces tactical communications and reconnaissance systems, night-vision equipment, complex space sensors, and other defense electronics products. L3Harris Technologies is also a member of the S&P 500 Index.

So, why am I bullish on L3Harris Technologies following its recent correction?

I view the recent correction as an excellent buying opportunity, as it continues to expand its international reach, as evidenced by the most recent partnership with the EDGE Group to enhance the defense capabilities of the United Arab Emirates, including AI and automation. The overall global push to increase defense spending and modernize defense capabilities should provide long-term, reliable government contracts for LHX.

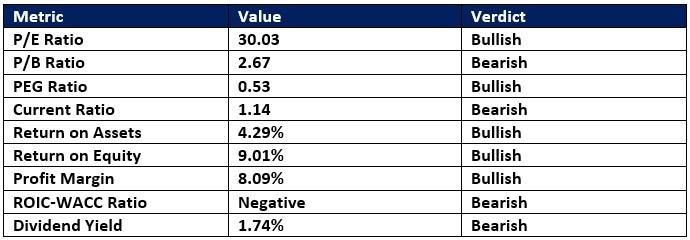

L3Harris Technologies Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 30.03 makes LHX a reasonably priced stock. By comparison, the P/E ratio for the S&P 500 is 30.61.

The average analyst price target for L3Harris Technologies is $334.16. It suggests excellent upside potential with decreasing downside risks.

L3Harris Technologies Technical Analysis

L3Harris Price Chart

- The LHX D1 chart shows price action between its descending 0.0% and 38.2% Fibonacci Retracement Fan levels.

- It also shows L3Harris Technologies bouncing off a massive horizontal support zone.

- The Bull Bear Power Indicator is bearish with an ascending trendline, nearing a potential bullish crossover.

My Call on L3Harris Technologies

I am taking a long position in L3Harris Technologies between $277.93 and $280.69. I am bullish on the product and services portfolio, including its defense and civil aviation services, and the 5-year PEG ratio confirms the company remains undervalued.

- LHX Entry Level: Between $277.93 and $280.69

- LHX Take Profit: Between $317.45 and $334.16

- LHX Stop Loss: Between $260.22 and $262.98

- Risk/Reward Ratio: 2.23

RTX Corporation Fundamental Analysis

RTX Corporation (RTX) is a defense and aerospace conglomerate, one of the largest global aerospace and defense manufacturers by revenue and market capitalization, and a major contractor to the intelligence community. RTX Corporation is also a member of the S&P 100 and the S&P 500.

So, why am I bullish on RTX Corporation at current levels?

RTX Corporation offers a nice combination of civil services through its Pratt & Whitney unit, exposure to the rapidly expanding space sector through its Collins Aerospace unit, and a highly lucrative, government-facing revenue stream through its Raytheon unit, which includes advanced sensors, training, software, and cybersecurity solutions. I am bullish on its expertise in missiles, as the Pentagon upgrades and expands its weapons arsenal.

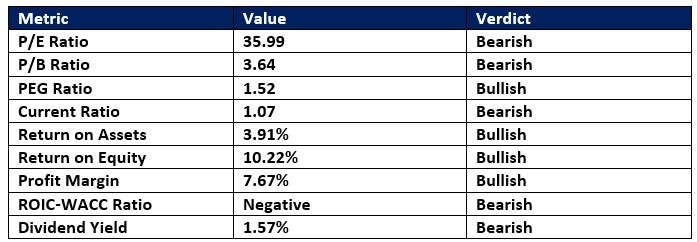

RTX Corporation Fundamental Analysis Snapshot

The price-to-earning (P/E) ratio of 35.99 makes RTX an expensive stock. By comparison, the P/E ratio for the S&P 500 is 30.61.

The average analyst price target for RTX Corporation is $193.79. It suggests moderate upside potential with acceptable downside risks.

RTX Corporation Technical Analysis

RTX Corporation Price Chart

- The RTX D1 chart shows price action approaching its ascending 50.0% Fibonacci Retracement Fan level with enough momentum for a breakout.

- It also shows RTX Corporation breaking out above a horizontal support zone.

- The Bull Bear Power Indicator turned bullish with an ascending trendline.

My Call on RTX Corporation

Top Regulated Brokers

I am taking a long position in RTX Corporation between $173.00 and $176.30. I am buying the dual surge in defense spending and commercial air travel, both of which RTX serves with industry-leading expertise.

- RTX Entry Level: Between $173.00 and $176.30

- RTX Take Profit: Between $193.79 and $203.48

- RTX Stop Loss: Between $163.87 and $165.50

- Risk/Reward Ratio: 2.28

Ready to trade our analysis of the best defense stocks? Here is our list of the best stock brokers worth checking out.