Short Trade Idea

Enter your short position between $355.15 (Friday’s intra-day low) and $370.65 (the intra-day low of a previous breakdown).

Market Index Analysis

- Broadcom (AVGO) is a member of the NASDAQ 100, the S&P 100, and the S&P 500.

- All three indices trade inside bearish chart patterns with mounting downside pressure.

- The Bull Bear Power Indicator of the NASDAQ 100 turned bearish with a descending trendline.

Market Sentiment Analysis

Equity futures are rising this morning, following the AI sell-off that prompted a rotation out of the sector last week. Markets await the delayed release of October’s non-farm payroll and retail sales data tomorrow, while the CPI report will follow on Thursday. China’s factory output and retail sales have weakened drastically in November, adding to global economic woes. Analysts have grown more bullish on 2026, fueled by hopes for a dovish Fed, which could increase monetary stimulus and drive tech shares higher, while ignoring inflationary concerns and high debt levels.

Broadcom Fundamental Analysis

Broadcom designs, develops, manufactures, and supplies semiconductor and infrastructure software products. It primarily serves the data center, networking, software, broadband, wireless, storage, and industrial markets.

So, why am I bearish on AVGO amid the ongoing AI boom?

Revenues of $18.02 billion and earnings-per-share of $1.95 beat expectations of $17.49 billion and $1.86, respectively. Still, its cautious guidance rattled the AI sector, confirming that markets have raced ahead of reality. While I like the long-term prospects of Broadcom, I turned bearish in the medium term, as the current share price and valuations are excessive given shrinking profit margins. Inside selling adds to short-term downside pressure.

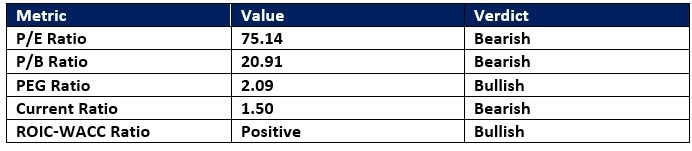

Broadcom Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 75.14 makes AVGO an expensive stock. By comparison, the P/E ratio for the NASDAQ 100 is 34.13.

The average analyst price target for AVGO is $452.56. This suggests an excellent upside potential, but rising downside risks.

Broadcom Technical Analysis

Today’s AVGO Signal

Broadcom Price Chart

- The AVGO D1 chart shows price action breaking down below a horizontal resistance zone.

- It also shows price action between its ascending 0.0% and 38.2% Fibonacci Retracement Fan levels.

- The Bull Bear Power Indicator turned bearish with a descending trendline.

- Bearish trading volumes have spiked during the breakdown.

- AVGO corrected with the NASDAQ 100, a bearish confirmation.

My Call on Broadcom

I am taking a short position in AVGO between $355.15 and $370.65. Valuations for AI stocks, high debt levels, and concerns over future spending pose significant headwinds for Broadcom, magnified by a cautious future outlook and shrinking profit margins.

- AVGO Entry Level: Between $355.15 and $370.65

- AVGO Take Profit: Between $302.25 and $317.35

- AVGO Stop Loss: Between $381.03 and $394.19

- Risk/Reward Ratio: 2.04

Ready to trade our analysis of Broadcom? Here is our list of the best stock brokers worth checking out.