Long Trade Idea

Enter your long position between $25.75 (the lower band of its horizontal support zone) and $28.28 (the upper band of its horizontal support zone).

Market Index Analysis

- Comcast (CMCSA) is a member of the NASDAQ 100, S&P 100, and the S&P 500.

- All three indices extend their recent recovery amid rising bearish volumes.

- The Bull Bear Power Indicator of the S&P 500 is bullish but shows a descending trendline.

Market Sentiment Analysis

Equity markets rebounded yesterday following a bearish day, and futures are pointing higher this morning. The bounce in Bitcoin and the rise in AI-related stocks dominated trading yesterday and are likely to shape the market throughout December. Today’s ADP report could inject volatility, as it is the last labor market snapshot before the FOMC’s last meeting of the year, when markets expect another 25-basis-point interest rate cut. After Marvell Technology beat earnings yesterday, investors will receive earnings from Salesforce, Macy’s, and Dollar Tree.

Comcast Fundamental Analysis

Comcast is a media and entertainment conglomerate. It is also the world’s fourth largest media company measured by revenue. In the US, it is the third-largest pay TV company, the second-largest cable TV company, and the largest internet service provider.

So, why am I bullish on CMCSA after its healthy correction?

The ongoing streamlining and restructuring, including separating all cable networks into its new company, Versant, and its bid to acquire Warner Bros., and combine it with NBCUniversal and HBO into a separate entertainment entity, will unlock shareholder value. The dividend yield is higher than its P/E ratio, and I remain bullish on its push into sports and impact on its streaming business.

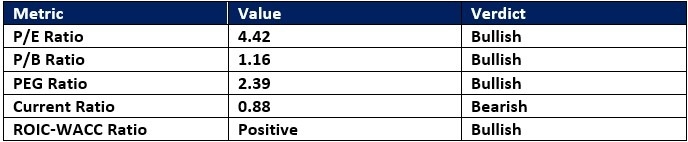

Comcast Fundamental Analysis Snapshot

The price-to-earning (P/E) ratio of 4.42 makes CMCSA an inexpensive stock. By comparison, the P/E ratio for the S&P 500 is 30.73.

The average analyst price target for CMCSA is $34.65. This suggests moderate upside potential, but I expect upward revisions, while downside risks remain reasonable.

Comcast Technical Analysis

Today’s CMCSA Signal

Comcast Price Chart

- The CMCSA D1 chart shows price action inside a horizontal support zone.

- It also shows price action between its descending 0.0% and 38.2% Fibonacci Retracement Fan level.

- The Bull Bear Power Indicator is bearish with an ascending trendline, approaching a bullish crossover.

- The average trading volumes have been higher during bearish days than during bullish days.

- CMCSA flatlined as the S&P 500 Index advanced, a bearish development, but bullish catalysts are mounting.

Top Regulated Brokers

My Call on Comcast

I am taking a long position in CMCSA between $25.75 and $28.28. I remain bullish on its restructuring efforts and its push into live sports streaming, while its P/B ratio limits downside risk.

- CMCSA Entry Level: Between $25.75 and $28.28

- CMCSA Take Profit: Between $36.66 and $38.40

- CMCSA Stop Loss: Between $23.24 and $24.46

- Risk/Reward Ratio: 4.36

Ready to trade our analysis of Comcast? Here is our list of the best stock brokers worth reviewing.