Short Trade Idea

Enter your short position between $214.34 (an intra-day high before a two-day push lower) and $218.67 (yesterday’s intra-day high).

Market Index Analysis

- DoorDash (DASH) is a member of the NASDAQ 100 and the S&P 500.

- Both indices extend their recent recovery amid rising bearish volumes.

- The Bull Bear Power Indicator of the S&P 500 is bullish but shows a descending trendline.

Market Sentiment Analysis

Equity markets rebounded yesterday following a bearish day, and futures are pointing higher this morning. The bounce in Bitcoin and the rise in AI-related stocks dominated trading yesterday and are likely to shape the market throughout December. Today’s ADP report could inject volatility, as it is the last labor market snapshot before the FOMC’s last meeting of the year, when markets expect another 25-basis-point interest rate cut. After Marvell Technology beat earnings yesterday, investors will receive earnings from Salesforce, Macy’s, and Dollar Tree.

DoorDash Fundamental Analysis

DoorDash is the largest food delivery company in the US, with a 56% market share and a 60% share in convenience store deliveries. It caters to over 450,000 merchants, over 20,000,000 users, and employs over 1,000,000 couriers.

So, why am I bearish on DASH following its earnings miss?

The earnings-per-share miss, where DoorDash reported $0.55 versus $0.69 expected, and the announcement of an increase in capital expenditures next year amid its build-out of robotic deliveries are likely to put downside pressure on the stock for several quarters. Valuations are excessive and higher than those of many AI-related companies, while the competition heats up, especially with Uber Eats, Instacart, and Amazon. The latter is testing 30-minute deliveries, and DoorDash remains poised to lose market share.

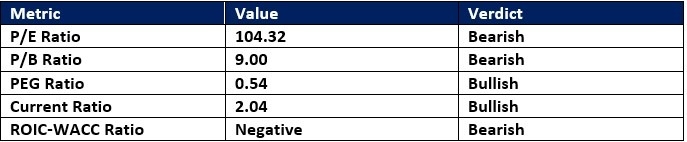

DoorDash Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 104.32 makes DASH an expensive stock. By comparison, the P/E ratio for the S&P 500 is 30.73.

The average analyst price target for DASH is $276.17. It suggests good upside potential, but I see downward revision and increasing downside risks.

DoorDash Technical Analysis

Today’s DASH Signal

- The DASH D1 chart shows price action inside a bearish price channel.

- It also shows price action between its descending 38.2% and 50.0% Fibonacci Retracement Fan level.

- The Bull Bear Power Indicator turned bullish with a descending trendline.

- The average trading volumes have been higher during bearish days than during bullish days.

- DASH advanced with the S&P 500, a bullish confirmation, but bearish catalysts have amassed.

My Call on DoorDash

I am taking a short position in DASH between $214.34 and $218.67. The increased competition from Amazon’s 30-minute delivery, high capital expenditures, and excessive valuations are behind my bearish assessment.

- DASH Entry Level: Between $214.34 and $218.67

- DASH Take Profit: Between $155.40 and $162.56

- DASH Stop Loss: Between $238.00 and $244.17

- Risk/Reward Ratio: 2.49

Ready to trade our analysis of DoorDash? Here is our list of the best stock brokers worth reviewing.