Long Trade Idea

Enter your long position between $186.76 (the lower band of its horizontal support zone) and $192.55 (the upper band of its horizontal support zone).

Market Index Analysis

- Honeywell International (HON) is a member of the Dow Jones Industrial Average, NASDAQ 100, the S&P 100, and the S&P 500.

- All four indices have recovered over the past five sessions amid decreasing volumes but have notched lower highs.

- The Bull Bear Power Indicator for the S&P 500 is bullish, but below its descending trendline.

Market Sentiment Analysis

Equity markets started the month of December with a sell-off, snapping a five-day bull run, and futures are pointing lower this morning. Concerns over the AI bubble, high valuations across the market, and stubborn inflation remained front and center. While chances for an interest rate cut have surged to 87%, after dropping to almost 30% two weeks ago, this will fail to address valuation and AI spending concerns but could fuel the bubble. The sell-off in cryptocurrencies, closely related to the AI hype, also weighed on sentiment.

Honeywell International Fundamental Analysis

Honeywell International is a conglomerate with aerospace, building automation, industrial automation, and energy and sustainability solutions (ESS) at its core. Additionally, it operates Sandia National Laboratories and has a global workforce of over 100,000 employees.

So, why am I bullish on HON following its post-earnings correction?

Honeywell completed the spin-off of its Advanced Materials a few weeks ago and plans to complete the spin-off of its Automation and Aerospace Technologies, creating three separate entities. I remain bullish on the process, as I see HON unlocking shareholder value, streamlining operations, and gaining competitiveness across the board. I rank HON among the best manufacturing stocks with tremendous upside in its defense and data center business.

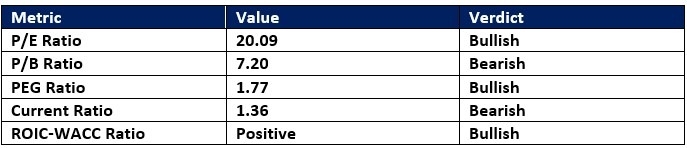

Honeywell International Fundamental Analysis Snapshot

The price-to-earning (P/E) ratio of 20.09 makes HON an inexpensive stock. By comparison, the P/E ratio for the S&P 500 is 30.78.

The average analyst price target for HON is $241.67. This suggests excellent upside potential with low downside risks.

Honeywell International Technical Analysis

Today’s HON Signal

Honeywell International Price Chart

- The HON D1 chart shows price action inside its horizontal support zone.

- It also shows price action between its descending 0.0% and 38.2% Fibonacci Retracement Fan levels.

- The Bull Bear Power Indicator is bearish with an ascending trendline.

- Average bullish trading volumes are higher than average bearish trading volumes over the past five sessions.

- HON stabilized as the S&P 500 Index advanced, a bearish signal, but bullish indicators have accumulated.

My Call on Honeywell International

I am taking a long position in HON between $186.76 and $192.55. I am bullish on its ongoing split into three companies, while I see benefits from increased defense spending and data center demand.

Top Regulated Brokers

- HON Entry Level: Between $186.76 and $192.55

- HON Take Profit: Between $227.74 and $241.67

- HON Stop Loss: Between $168.55 and $177.42

- Risk/Reward Ratio: 2.25

Ready to trade our analysis of Honeywell International? Here is our list of the best stock brokers worth checking out.