Short Trade Idea

Enter your short position between $42.51 (yesterday’s intra-day low) and $44.02 (the upper band of its horizontal resistance zone).

Market Index Analysis

- Intel (INTC) is a member of the NASDAQ 100, the Dow Jones Industrial Average, the S&P 100, and the S&P 500.

- All four indices advance inside bearish chart patterns with rising bearish trading volumes.

- The Bull Bear Power Indicator of the NASDAQ 100 Index is positive but below its descending trendline.

Market Sentiment Analysis

Equity markets have continued their reversal from November’s lows, driven by hopes that the US central bank will deliver a Christmas gift in the form of a 25-basis point interest rate cut. Still, conditions from November’s sell-off persist, and lower interest rates will not address them. While the holiday shopping season started at a record-setting pace, it masked the weakening consumer. Adding to consumer worries is the weakening labor market, while inflation remains stubborn. The AI bubble conversation began to shift into air-pocket talk. Still, uncertainty continues to accompany the AI trade, with Snowflake’s earnings miss being the latest reminder of an overvalued sector.

Intel Fundamental Analysis

Intel is a technology company that primarily designs CPUs for business and consumer markets. It lost its leadership position to AMD and missed out on the AI wave, while its future chips will rely heavily on TSMC.

So, why am I bearish on INTC despite recent developments?

The investment in Malaysia, the hype surrounding a potential Apple deal, and the announcement to keep its networking and communication unit drove headlines, but underlying operational risks remain. I am bearish on the 10% government stake in Intel, its reliance on TSMC for future chips, and its dismal operating margins, which continue to contract. At the same time, the outlook remains uncertain, as evidenced by its dividend decrease.

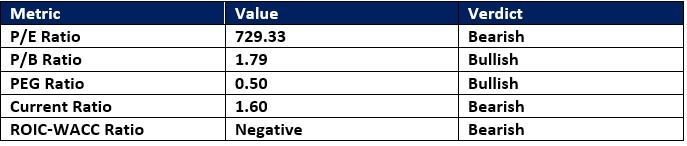

Intel Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 729.33 makes INTC an expensive stock. By comparison, the P/E ratio for the NASDAQ 100 is 34.62.

The average analyst price target for INTC is $37.27. It shows price action overshot the target, while downside risks have magnified exponentially.

Intel Technical Analysis

Today’s INTC Signal

Intel Price Chart

- The INTC D1 chart shows price action potentially forming a new horizontal resistance zone.

- It also shows price action between its ascending 0.0% and 38.2% Fibonacci Retracement Fan levels.

- The Bull Bear Power Indicator is bullish but shows a negative divergence.

- The average bearish trading volumes are higher than the average bullish trading volumes.

- INTC rallied with the NASDAQ 100 Index, a bullish confirmation, but bearish catalysts have emerged.

My Call on Intel

Top Regulated Brokers

I am taking a short position in INTC between $42.51 and $44.02. I remain bearish amid excessive valuations, weakening margins, and fears that the current share price reflects the good news.

- INTC Entry Level: Between $42.51 and $44.02

- INTC Take Profit: Between $28.73 and $32.89

- INTC Stop Loss: Between $46.22 and $48.53

- Risk/Reward Ratio: 3.71

Ready to trade our analysis of Intel? Here is our list of the best stock brokers worth reviewing.