Long Trade Idea

Enter your long position between $262.91 (an intermediate horizontal support level) and $272.82 (yesterday’s intra-day high).

Market Index Analysis

- Labcorp (LH) is a member of the S&P 500.

- This index has recovered over the past five sessions amid decreasing volumes but has notched lower highs.

- The Bull Bear Power Indicator for the S&P 500 is bullish, but below its descending trendline.

Market Sentiment Analysis

Equity markets began December with a sell-off, snapping a five-day bull run, and futures are pointing lower this morning. Concerns over the AI bubble, high valuations across the market, and stubborn inflation remained front and center. While hopes for an interest rate cut have surged to nearly 80%, after dropping to almost 40% two weeks ago, it will fail to address valuation and AI spending concern but could fuel the bubble. The sell-off in cryptocurrencies, closely related to the AI hype, also weighed on sentiment.

Labcorp Fundamental Analysis

Labcorp operates in over 100 countries, making it one of the largest clinical laboratory networks globally. Still, it derives most of its business from the US. Labcorp has over 70,000 employees, processes more than 160 million tests annually, and receives over 10% of its revenues from Medicaid.

So, why am I bullish on LH amid its recent rally?

The publication of new plasma detect MRD data in two recent peer-reviewed publications added to the revenue potential of Labcorp Plasma Detect in the $110+ billion global cancer diagnostics market. I am equally bullish on the AI-powered digital pathology collaboration between Labcorp and Lunit, which already yielded research results presented at key scientific conferences. Valuations are reasonable, and I see more upside for LH.

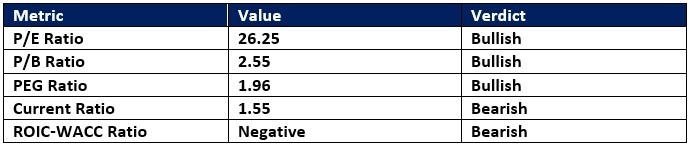

Labcorp Fundamental Analysis Snapshot

The price-to-earning (P/E) ratio of 26.25 makes LH a reasonably priced stock. By comparison, the P/E ratio for the S&P 500 is 30.78.

The average analyst price target for LH is $299.71. This suggests good upside potential with manageable downside risks.

Labcorp Technical Analysis

Today’s LH Signal

Labcorp Price Chart

- The LH D1 chart shows price action inside a bullish price channel.

- It also shows price action challenging its ascending 38.2% Fibonacci Retracement Fan level for a breakout.

- The Bull Bear Power Indicator is bullish with an ascending trendline.

- The average bullish trading volumes are higher than the average bearish trading volumes.

- LH advanced with the S&P 500, a bullish confirmation.

My Call on Labcorp

I am taking a long position in LH between $262.91 and $272.82. I am bullish on recent announcements, valuations are reasonable, and the 2025 EPS upgrade on the back of sound operational metrics should yield more upside.

- LH Entry Level: Between $262.91 and $272.82

- LH Take Profit: Between $299.71 and $308.70

- LH Stop Loss: Between $244.52 and $252.46

- Risk/Reward Ratio: 2.061

Top Regulated Brokers

Ready to trade our analysis of Labcorp? Here is our list of the best stock brokers worth checking out.