- The NASDAQ 100 rallied a bit in the shortened Friday session, as we continue to see a lot of bullish pressure in the stock markets.

- This is an index that continues to focus on a handful of stocks, and it is also worth noting that on Friday, we saw Intel skyrocket by gaining over 10%, having an effect on this index overall.

Technical Analysis

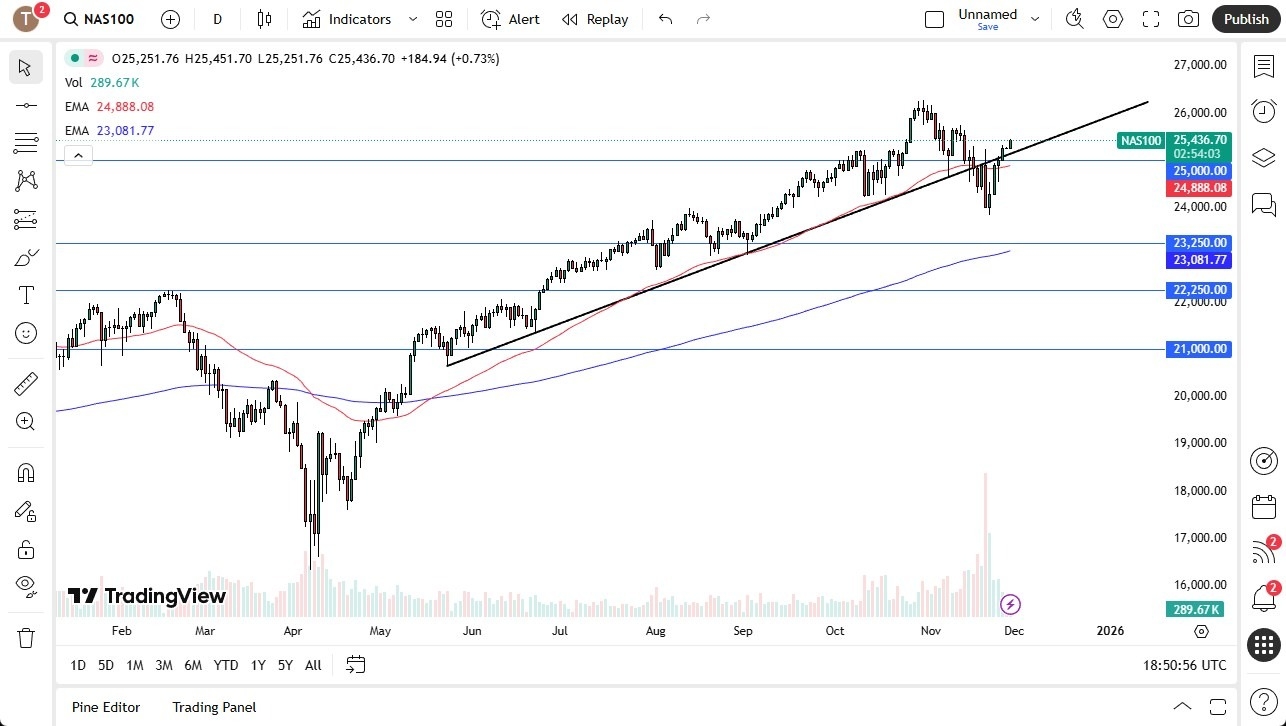

The NASDAQ 100 broke above the previous trendline that has been so important in the past, and clearing it shows the momentum is still clear with the buyers, and it should be noticed by traders that the 50 Day EMA is sitting just below the 25,000 level, an area that will matter from a large, round, psychological point of view as well. The size of the candle for the Friday session isn’t huge, but it is positive, and this is the main takeaway.

Top Regulated Brokers

The market will also be getting a potential “Santa Claus Rally” in the next few sessions, as traders will possibly be trying to pick up some gains as we head into the New Year holiday. The market will have money managers that are looking to pad results, and perhaps just as importantly, make sure their clients understand that they own “the correct stocks.”

If we do break lower, perhaps below the 50 Day EMA, the market will then focus on the 24,000 level, and then the 200 Day EMA and the 23,500 level. This should be the floor in the market, and if we were to break below this area, then the market could be in serious trouble. That being said, this is a market that should go higher over the long term, and perhaps attempt to reach the 26,000 level above, possibly even higher than that.

This market continues to see a lot of noise, but at the end of the day, traders are still looking to the upside for the bigger move, and this is the way forward from everything I see here. How strong the move is to the upside remains to be seen.

Ready to trade our stock market forecast and analysis? Here are the best CFD stocks brokers to choose from.