Short Trade Idea

Enter your short position between $181.40 (yesterday’s intra-day low) and $193.55 (a minor horizontal resistance level).

Market Index Analysis

- Oracle (ORCL) is a member of the S&P 100 and the S&P 500.

- Both indices trade inside bearish price channels with increasing downside momentum.

- The Bull Bear Power Indicator of the S&P 500 is bullish with a descending trendline, approaching a bearish crossover.

Market Sentiment Analysis

Equity futures are down this morning, building on the rotation out of extremely overvalued AI stocks, as issues from high debt levels to circular financing, and from revenue concerns to valuations, begin to materialize. Today’s focus will be on the delayed October NFP report, expected to show 40,000 job additions with an unemployment rate of 4.4%, while Thursday’s CPI report is expected to reveal an annualized inflation rate of 3.1%. Investors hope for a weak enough job market to prompt another interest rate cut, but strong enough to support economic expansion, which creates a risky investment case given stubborn inflation.

Oracle Fundamental Analysis

Oracle is among the 20 largest companies in the world, selling database software, enterprise applications, and cloud infrastructure and hardware. It is also a member of the US-based Stargate joint venture with OpenAI, SoftBank, and MGX.

So, why am I bearish on ORCL despite its nearly 50% slump?

Revenues of $16.06 billion missed expectations of $16.21 billion, while adjusted earnings-per-share of $2.26 beat estimates of $1.64. I remain bearish on its revenue miss, which does not justify the rising capital expenditures Oracle raised above $50 billion. I am equally concerned about its $10 billion in negative free cash flow from operations, its increasing debt level above $80 billion, and declining profit margins.

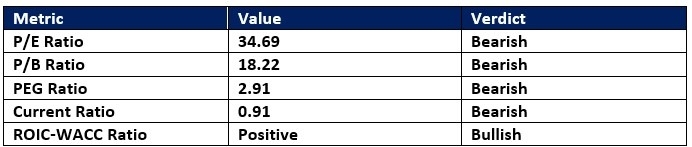

Oracle Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 34.69 makes ORCL an expensive stock. By comparison, the P/E ratio for the S&P 500 is 29.09.

The average analyst price target for ORCL is $291.11. While it suggests excellent upside potential, downward revisions are coming in, and downside risks remain excessive.

Oracle Technical Analysis

Today’s ORCL Signal

Oracle Price Chart

- The ORCL D1 chart shows price action inside a horizontal support zone.

- It also shows price action challenging the descending 0.0% Fibonacci Retracement Fan level for a potential breakdown.

- The Bull Bear Power Indicator is bearish with a descending trendline.

- The average bearish trading volumes are higher than average bearish trading volumes since the correction.

- ORCL corrected far steeper than the NASDAQ 100, a significant bearish confirmation.

Top Regulated Brokers

My Call on Oracle

I am taking a short position in ORCL between $181.40 and $193.55. I remain bearish on its revenue potential, high debt levels, and shrinking profit margins.

- ORCL Entry Level: Between $181.40 and $193.55

- ORCL Take Profit: Between $130.99 and $137.70

- ORCL Stop Loss: Between $204.96 and $210.00

- Risk/Reward Ratio: 2.14

Ready to trade our analysis of Oracle? Here is our list of the best stock brokers worth reviewing.