Long Trade Idea

Enter your long position between $108.00 (the lower band of its horizontal support zone) and $112.95 (the upper band of its horizontal support zone).

Market Index Analysis

- Paychex (PAYX) is a member of the NASDAQ 100 and the S&P 500.

- Both indices have recovered over the past five sessions amid decreasing volumes but have notched lower highs.

- The Bull Bear Power Indicator for the S&P 500 is bullish, but below its descending trendline.

Market Sentiment Analysis

Equity markets began December with a sell-off, snapping a five-day bull run, and futures are pointing lower this morning. Concerns over the AI bubble, high valuations across the market, and stubborn inflation remained front and center. While hopes for an interest rate cut have surged to nearly 80%, after dropping to almost 40% two weeks ago, it will fail to address valuation and AI spending concerns but could fuel the bubble. The sell-off in cryptocurrencies, closely related to the AI hype, also weighed on sentiment.

Paychex Fundamental Analysis

Paychex is a human resources, payroll, and employee benefits company focused on small- to medium-sized businesses. It has over 100 offices and serves over 740,000 clients across the US and Europe.

So, why am I bullish on PAYX despite its 30% correction?

The correction in Paychex remains closely related to a weakening labor market, but it has lowered valuations to reasonable levels. PAYX is the 401(k) record-keeper for 124,000 plans, and its recent implementation of AI added a bullish narrative, as it will give it a revenue boost. I am also bullish on PAYX’s free cash flow generation. The Paycor acquisition and high customer retention rates also add to a positive outlook.

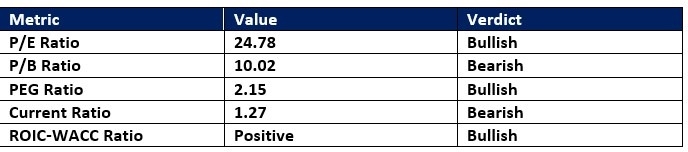

Paychex Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 24.78 makes PAYX a reasonably priced stock. By comparison, the P/E ratio for the S&P 500 is 30.78.

The average analyst price target for PAYX is $133.29. It suggests good upside potential with fading downside risks.

Paychex Technical Analysis

Today’s PAYX Signal

- The PAYX D1 chart shows price action inside its horizontal support zone.

- It also shows price action trading between its descending 0.0% and 38.2% Fibonacci Retracement Fan.

- The Bull Bear Power Indicator is bearish but shows a positive divergence.

- The average bearish trading volumes are higher than the average bullish trading volumes but are nearing capitulation.

- PAYX corrected as the S&P 500 recovered, a bearish signal, but bullish catalysts have emerged.

Top Regulated Brokers

My Call on Paychex

I am taking a long position in PAYX between $108.00 and $112.95. Valuations decreased to reasonable levels, the dividend yield compensates for short-term risk, and client retention creates a stable revenue flow.

- PAYX Entry Level: Between $108.00 and $112.95

- PAYX Take Profit: Between $129.24 and $133.29

- PAYX Stop Loss: Between $99.52 and $102.60

- Risk/Reward Ratio: 2.51

Ready to trade our analysis of Paychex? Here is our list of the best stock brokers worth checking out.