Short Trade Idea

Enter your short position between $40.74 (the lower band of its horizontal support zone) and $43.54 (the upper band of its horizontal support zone).

Market Index Analysis

- Southwest Airlines (LUV) is a member of the S&P 500.

- This index broke down below its horizontal resistance zone with rising bearish momentum.

- The Bull Bear Power Indicator of the S&P 500 turned bearish with a descending trendline.

Top Regulated Brokers

Market Sentiment Analysis

Equity markets extended their sell-off yesterday, led by AI-related tech stocks, after Oracle lost a financial backer for a $10 billion data center project. Equity futures are mixed this morning, after Micron earnings blew past expectations and shares rose over 10% in after-market trading. Markets will also receive October’s CPI report, where analysts expect the core CPI to increase to 3.1% annualized. Expectations for a January interest rate cut are roughly 25%, but the CPI report can inject volatility into today’s session.

Southwest Airlines Fundamental Analysis

Southwest Airlines is the fourth-largest US-based airline, serving over 100 destinations across 42 states and ten countries in the Gulf of Mexico and the Caribbean. It operates an all Boeing-737 fleet of over 810 aircraft. It also has over 500 Boeing-737 MAX on order.

So, why am I bearish on LUV following its nearly 50% rally?

While I appreciate the partnership with Turkish Airlines and the tests of its potential next-gen network strategy, I cannot ignore high valuations, shrinking profit margins, and concerns about travel appetite following the holiday season, as consumers remain stretched thin with more bad news on the horizon. The average return on invested capital trails the industry average significantly, and I am also concerned about its negative free cash flow.

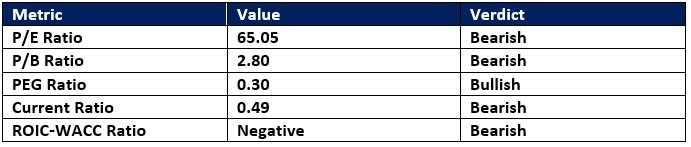

Southwest Airlines Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 65.05 makes LUV an expensive stock. By comparison, the P/E ratio for the S&P 500 is 28.88.

The average analyst price target for LUV is $37.29. This suggests no upside potential, while downside risks have accelerated significantly.

Southwest Airlines Technical Analysis

Today’s LUV Signal

Southwest Airlines Price Chart

- The LUV D1 chart shows price action inside a newly formed horizontal resistance zone.

- It also shows price action between its ascending 0.0% and 38.2% Fibonacci Retracement Fan levels.

- The Bull Bear Power Indicator is bullish with a negative divergence.

- The average bullish trading volumes are higher than average bearish trading volumes, hinting at more turbulence ahead.

- LUV advanced to multi-year highs as the S&P 500 corrected, a significant bullish trading signal, but breakdown catalysts have risen this week.

My Call on Southwest Airlines

I am taking a short position in LUV between $40.74 and $43.54. I turned bearish due to shrinking profit margins, operational challenges, high valuations, and a cloudy outlook for the post-holiday season.

- LUV Entry Level: Between $40.74 and $43.54

- LUV Take Profit: Between $31.15 and $33.03

- LUV Stop Loss: Between $44.85 and $45.75

- Risk/Reward Ratio: 2.33

Ready to trade our analysis of Southwest Airlines? Here is our list of the best stock brokers worth reviewing.