Long Trade Idea

Enter your long position between $109.18 (the intra-day low of its last bearish candlestick before its post-earnings sell-off) and $111.15 (Friday’s intra-day low).

Market Index Analysis

- The Walt Disney Company (DIS) is a member of the Dow Jones Industrial Average, the S&P 100, and the S&P 500.

- All three indices trade inside bearish chart patterns with mounting downside pressure.

- The Bull Bear Power Indicator of the S&P 500 is bullish but shows a descending trendline and is approaching a bearish crossover.

Market Sentiment Analysis

Equity futures are rising this morning, following the AI sell-off that prompted a rotation out of the sector last week. Markets await the delayed release of October’s non-farm payroll and retail sales data tomorrow, while the CPI report will follow on Thursday. China’s factory output and retail sales have weakened drastically in November, adding to global economic woes. Analysts have grown more bullish on 2026, fueled by hopes for a dovish Fed, which could increase monetary stimulus and drive tech shares higher, while ignoring inflationary concerns and high debt levels.

Top Regulated Brokers

The Walt Disney Company Fundamental Analysis

The Walt Disney Company is a mass media and entertainment conglomerate, a leader in the animation industry, and operates the largest television and film studio in Hollywood.

So, why am I bullish on DIS after it reported mixed earnings?

While revenues of $22.46 billion fell short of expectations calling for $22.75 billion, adjusted earnings per share of $1.11 beat estimates of $1.05. Shares plunged over 10%, but I remain bullish on its flagship streaming service, Disney+, which added 3.8 million subscribers during the period, and now totals 131.6 million. I am also bullish on the $1 billion investment in OpenAI, which will add AI-driven content creation to its overall entertainment offering.

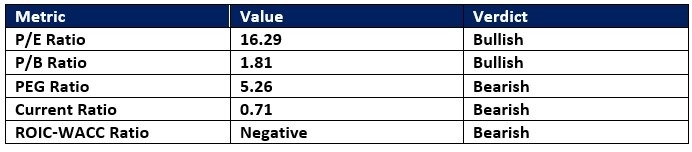

The Walt Disney Company Fundamental Analysis Snapshot

The price-to-earning (P/E) ratio of 16.29 makes DIS an inexpensive stock. By comparison, the P/E ratio for the S&P 500 is 29.29.

The average analyst price target for DIS is $132.50. It shows good upside potential with acceptable downside risks.

The Walt Disney Company Technical Analysis

Today’s DIS Signal

Walt Disney Price Chart

- The DIS D1 chart shows price action inside a bullish price channel.

- It also shows price action breaking out above its ascending Fibonacci Retracement Fan.

- The Bull Bear Power Indicator is bullish with an ascending trendline.

- The average bullish trading volumes are higher than the average bearish trading volumes.

- DIS rallied with the S&P 500, a bullish confirmation.

My Call on Walt Disney

I am taking a long position in DIS between $109.18 and $111.15. The OpenAI investment to add AI-generated content, low valuations, and healthy profit margins should push DIS higher.

- DIS Entry Level: Between $109.18 and $111.15

- DIS Take Profit: Between $128.43 and $132.50

- DIS Stop Loss: Between $101.89 and $104.08

- Risk/Reward Ratio: 2.64

Ready to trade our analysis of Walt Disney? Here is our list of the best stock brokers worth checking out.