Fundamental Analysis & Market Sentiment

I wrote on the 14th December that the best trades for the week would be:

- Long of the S&P 500 Index following a daily close above 6,920. This did not set up.

- Long of Silver with half the normal position size following a daily close above $63.57. This set up on Wednesday, and a gave a winning trade worth 1.37%.

- Long of Gold with half the normal position size following a daily close above $4,355.80. This did not set up.

Overall, these trades gave a gain of 0.46% per asset.

A summary of last week’s most important data:

- US CPI (inflation) – markets were surprised by a notably lower US inflation rate. An annualized rate of 2.7% was recorded while 3.1% was expected. According to the CME FedWatch tool, markets are still only pricing in two Fed rate cuts of 0.25% each for 2026, but expectations have shifted towards cuts. Despite this dovish tilt the US Dollar rose on the news, suggesting markets have become much less concerned with inflation, and are tending towards President Trump’s view that inflation is no longer a major concern.

- US Average Hourly Earnings – was expected to show a month-on-month increase of 0.3%, but came in at only 0.1%, suggesting lowering wage inflation pressures. That is another dovish signal for the USA.

- US Non-Farm Employment Change – this was approximately as expected.

- European Central Bank Policy Meeting – there were no surprises here.

- Bank of Japan Policy Meeting – a rate hike of 0.25% was delivered as expected. However, the big news was in the Bank’s statement that its real rate of interest (the interest rate minus the rate of inflation) would remain negative for the foreseeable future. This had a strong dovish effect on the Yen, it was about as dovish a hike as you could possibly imagine.

- US Retail Sales – this was flat, one tick lower than expected, suggesting a slowing US economy.

- Bank of England Policy Meeting – a rate cut of 0.25% was delivered as expected. There were no surprises.

- Canadian CPI (inflation) – as expected, it showed a month-on-month increase of 0.1%.

- UK CPI (inflation) – this was expected to show an annualised rate of 3.5%, but it came in surprisingly lower at 3.2%, which is a bit of a dovish tilt for the Pound.

- US / UK / Germany PMI Flash Services & Manufacturing – Germany and USA data was a bit worse than expected, but the UK was a little better than expected.

- New Zealand GDP – it was expected to show fairly strong quarterly growth of 0.8% but came in even higher at 1.1%.

- US Unemployment Rate – one tick higher than expected, at 4.6%, suggesting a slowing US economy.

- UK Retail Sales – this was considerably worse than expected, showing a slight contraction, which is a sign of a slowing UK economy.

- UK Claimant Count Change – approximately as expected.

Last week’s data had a marginal impact, with one exception: the Bank of Japan. Although this rate hike was expected, the Bank said that it could be expected that real interest rates will remain negative. This was a dovish shock, which sent the Yen tumbling, with every major currency gaining firmly against it. The Yen now looks like a great bet as a short component of any long-term trade, with some analysts now seeing it as the new Turkish Lira, but with a much cheaper spread.

The other thing which really stood out last week was the way market shrugged off a surprising drop in US inflation data. This did give the stock market a bit of a boost, but it was nothing special, and the S&P 500 Index is still off its recent high, even as we head towards the end of the year. This suggests two things might be true:

- The US stock market’s bull market is exhausted.

- Markets are no longer much concerned about high inflation in the USA, even though the rate is above the Fed’s target of 2%.

It is notable that the lower inflation rate has not shifted rate cut expectations for 2026 in a decisive way.

Finally, precious metals continued to rise strongly over the past week, which along with the Japanese Yen is probably the main thing for traders to be watching now. Arguably, the continuing rate cuts we are seeing by major central banks is giving precious metals a strong tailwind.

Top Regulated Brokers

The Week Ahead: 22nd – 26th December

The coming week includes the Christmas holiday, which includes public holidays in several major markets on Thursday and Wednesday or Friday in some cases. This will almost definitely mean a much less liquid and active market than usual.

We are likely to see a decrease in volatility this week. There is almost no high-impact data due.

This week’s most important data points, in order of likely importance, are:

- US Preliminary GDP

- Canadian GDP

- US Unemployment Claims

Monthly Forecast December 2025

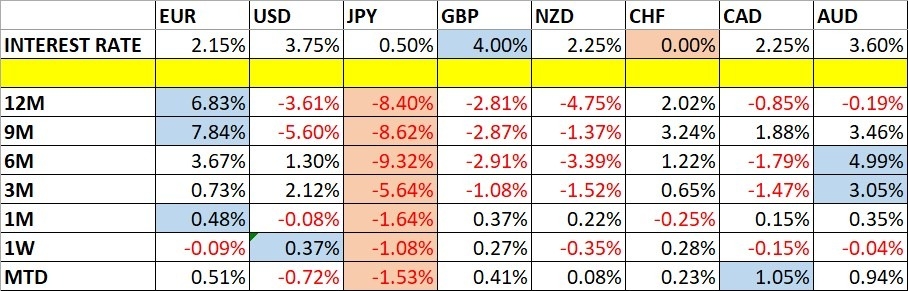

Currency Price Changes and Interest Rates

For the month of December 2025, I made no forecast.

Weekly Forecast 22nd December 2025

Last week, I made no forecast, as there were no recent excessive moves in currency crosses.

The US Dollar was the strongest major currency last week, while the Japanese Yen was the weakest. Directional volatility fell again last week, with only 11% of all major pairs and crosses changing in value by more than 1%.

Next week’s volatility will almost certainly be even lower.

You can trade these forecasts in a real or demo Forex brokerage account.

Technical Analysis

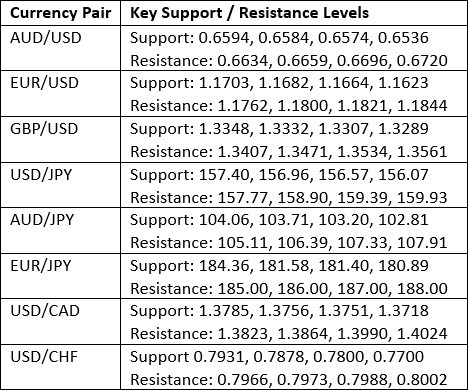

Key Support/Resistance Levels for Popular Pairs

Key Support and Resistance Levels

US Dollar Index

Last week, the US Dollar Index printed a bullish pin bar. The price is now above its levels of 13 weeks ago and of 26 weeks ago, so by my preferred metric, I declare a long-term bullish trend. The problem with that though, is that the price is just consolidating, and there is very low separation within that metric, so I have no faith in it.

US inflation came in unexpectedly low last week, but the Dollar rose. You could say that is a bullish sign for the greenback, with the market ignoring bearish news. However, the inflation print did not significantly shift rate cut expectations, so I don’t see this as a bullish sign.

I take no bias on the US Dollar right now.

US Dollar Index Weekly Price Chart

US Dollar Index Weekly Price Chart

USD/JPY

The USD/JPY currency pair weekly chart printed a powerful bullish engulfing (outside) candlestick that is very close to testing the 2025 high. The price closed right on its high. There are lots of bullish signs here.

Drilling down, this is really about the Japanese Yen and not the US Dollar – the greenback, as I have already said, is consolidating, although it may be a bit bullish. The Yen is the big story, and it all happened on Friday when the Bank of Japan made a rate cut but effectively committed to keeping negative real interest rates for the foreseeable future, because it cannot service the huge level of debt in Japan without this. This signifies that the BoJ is happy to let the Yen depreciate, provided the moves are orderly and within an acceptable range of volatility.

It is rare for traders to get a signal from a central bank that is tradable, but we have one now. There may be pullbacks and the moves may be slow, but short Japanese Yen looks like an excellent medium to long-term bet.

I am long this currency pair. Over the short-term bulls might do well to be mindful of the swing high at ¥158.88.

USD/JPY Price Chart

CHF/JPY

The CHF/JPY currency cross weekly chart printed a powerful bullish candlestick that reached an all-time high price. This alone is a notably bullish sign but just look at the orderly ascending trend we have seen here since March this year, shown by the linear regression price channel study in the price chart below.

I usually ignore trends in currency crosses, but this is a powerful one. There are also good fundamental reasons why the Swiss Franc has been the strongest major currency over the long term, and the Japanese Yen has been the weakest.

The Swiss Franc has a zero interest rate but deflation, so the currency is naturally appreciating, while the Japanese Yen has been declining for a long time due to an ultra-loose monetary policy. The Bank of Japan said on Friday it would maintain negative real interest rates even as it begins to hike, and that has been enough to send the Yen tumbling and giving a very strong signal that the Yen is likely to decline further.

I will not be going long here myself, but it is something other traders might want to investigate and consider. As the USD is not doing very much and the bet here is short Yen, it might make sense to be long of a basket of currencies or assets against the Yen, and the Swiss Franc should probably be included in that.

CHF/JPY Weekly Price Chart

S&P 500 Index

The daily price chart below shows that this major US stock index gained slightly last week, after coming very close to breaking its record high just a few weeks ago. It ended Friday right on its high, which is a bullish sign, and within reach of its record high.

Although the chart looks technically bullish, I think the boost here is all about the lower-than-expected US inflation data which was released on Thursday. The Index had been falling steadily over the past week until that release.

The all-time high here is not far from the big round number at 7,000. As we are about to enter a low-liquidity market period, I think it will be wise to only enter a new long trade here if we get a daily close above that level, without a significant upper wick on the daily candlestick used to trigger the entry.

S&P 500 Index Daily Price Chart

XAG/USD

A few weeks / months ago, Silver was in a strong bullish trend which saw the price increase by about 50% in only two months. The rise peaked in October and saw quite a strong retracement, which is usually a sign that the price is not going to make new highs soon. This bearish outlook was reinforced by what seemed to be a bearish double top formed just five weeks ago. However, the price has come up again and then made a very strong bullish breakout with an unusually large move.

We saw a further gain last week as the outsize bullish momentum continued. Volatility is high and the moves can be messy but it’s a bullish breakout that continues to advance.

Another bullish factor is that all the major precious metals rose in value last week, although there is no doubt the Silver is leading the way.

Be mindful of the high volatility, but as last week saw another very bullish move and ended very close to the high, I think being long here is a good idea, but a half normal position size is probably wise.

Silver Weekly Price Chart

XPT/USD

Platinum had its best week last week in years. It ended the week right at its high, and above the round number at $2,000. Platinum has not reached these prices since 2008.

With the strong advances we are seeing in several other precious metals, it makes sense to be long here, but of course the high recent volatility makes it very easy for a stop loss to be hit if you are using a long-term ATR to size your stop loss and position size, so be mindful of that.

It might be wise for any new entry to be made with half normal position size.

Platinum Weekly Price Chart

XAU/USD

All precious metals have been rising as an asset class, partly fueled by Fed policies and the declining Dollar, partly due to safe haven inflow.

Silver has clearly been leading the way, but these past two weeks have seen the price Gold start to catch up with a minor bullish breakout beyond the $4,270 area. The price got close to the record high last week, but the weekly candlestick was a small doji, which signifies indecision.

I will keep a close eye on Gold and enter a new long trade if we get a daily close above the record high, at or above $4,355.80.

If this long trade sets up, as the progress upwards has been steadier and more orderly than what we have seen in Silver, you might keep a normal position size. I prefer to use half my normal position size.

Gold Weekly Price Chart

Bottom Line

I see the best trades this week as:

- Long of the USD/JPY currency pair.

- Long of the S&P 500 Index following a daily close above 7,000.

- Long of Silver with half the normal position size.

- Long of Platinum with half the normal position size.

- Long of Gold with half the normal position size following a daily close above $4,355.80.

Ready to trade our weekly Forex forecast? Check out our list of the top 100 Forex brokers.