The XRP/USD pair is down 7% over the last 24 hours, sliding below the $2 mark to trade at $1.88 at the time of writing on Tuesday, Dec. 16.

XRP/USD daily chart. Source: TradingView

The moving averages have started to turn down, and the RSI is in the negative territory, indicating bears are in control.

China BTC Miners Shut Down in Xinjiang

On Monday, December 15, reports emerged of a renewed crackdown by the Chinese Communist Party (CCP) on underground Bitcoin mining in Xinjiang, resulting in the shutdown of approximately 1.3–2 GW of power capacity.

This affected 400,000–500,000 mining rigs, removing roughly 100 EH/s (8–10%) from Bitcoin's global hashrate—the sharpest drop since the 2024 halving.

The event triggered short-term bearish sentiment. Miners facing abrupt closures may liquidate BTC holdings to cover costs, while fears of displaced capacity flooding secondary markets added selling pressure. Combined with high leverage in derivatives and Asia-session weakness, this contributed to millions in crypto liquidation.

In the last 24 hours, Bitcoin fell approximately 4.5%, declining from above $90,000 to around $85,500. The broader market followed, with Ethereum dropping 6.7%, to trade below $3,000.

XRP, which operates on a non-PoW consensus mechanism and is unaffected by mining disruptions, declined similarly by 7%, losing the key support level at $2.

Its performance reflected high correlation with Bitcoin during risk-off events, amplified by overall market contagion rather than direct exposure to the Xinjiang shutdowns. No Ripple-specific news drove outsized moves; XRP tracked the sector's downside amid renewed regulatory fears from China.

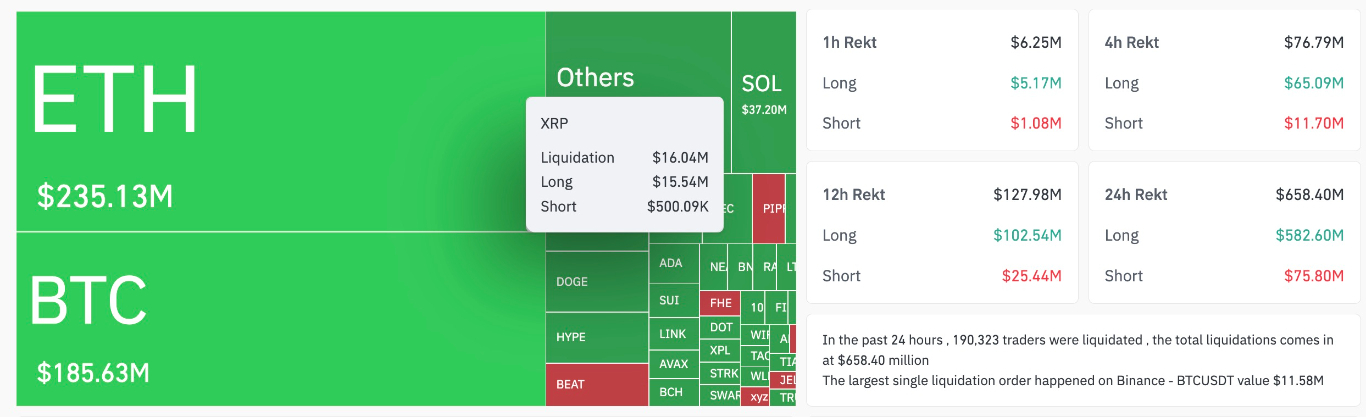

Crypto Liquidations Hit $660 Million

Around 190,323 traders have been liquidated to the tune of more than $658 million over the past 24 hours as major cryptocurrencies lost key support levels, slashing their gains after news emerged that mining farms are shutting down in China’s Xinjiang autonomous region.

The majority of liquidations were long positions, according to CoinGlass, which came as XRP price dropped to $1.88 on Bitstamp, its lowest price since November 21.

Over $582.6 million in long positions were liquidated, with Ethereum (ETH) accounting for $207 million of that total as it dropped 6% to $2,934, followed by Bitcoin with $170 million in long liquidations. XRP accounted for $15.54 million in long liquidations.

Crypto liquidations across all exchanges. Source: CoinGlass

More than $658.4 million in both long and short positions were liquidated across the crypto market.

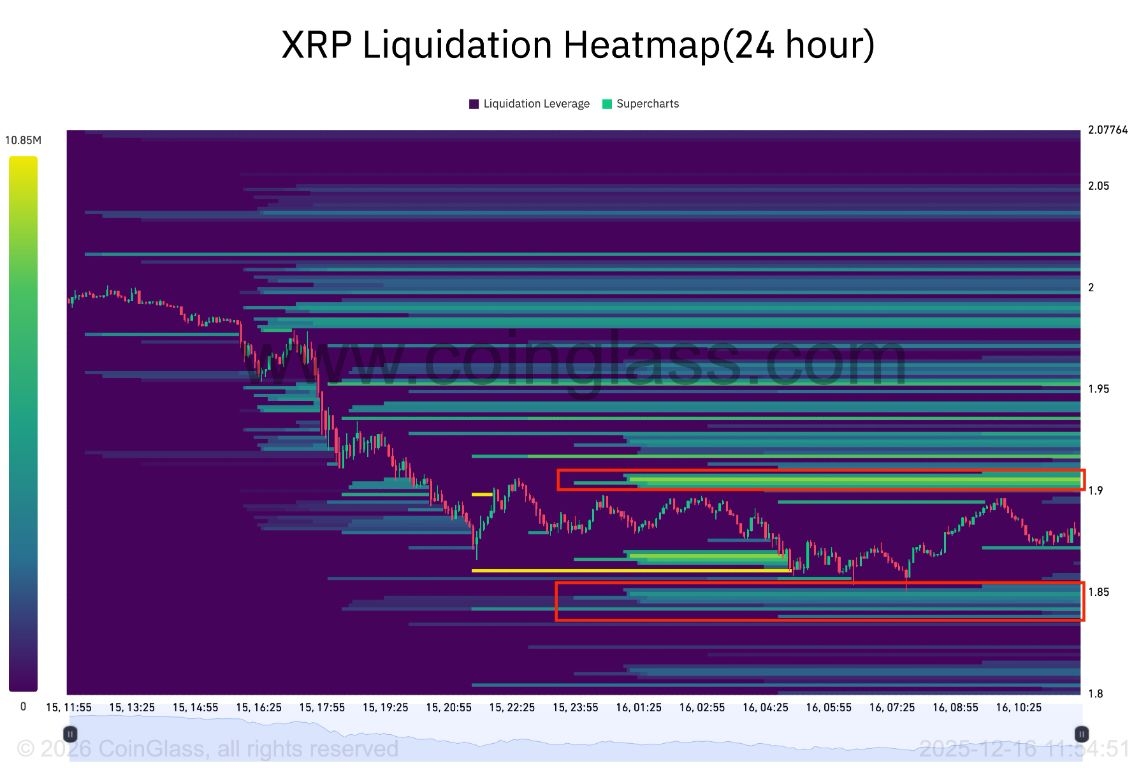

The XRP liquidation heatmap showed the price eating away liquidity below $2, with more than $450 million bid orders sitting between $1.87 and $1.85.

XRP liquidation heatmap. Source: CoinGlass

A break below $1.85 could see the price drop to grab liquidity, sitting down to the $1.80 level.

XRP Price Must Hold $1.85 to Avoid Deeper Correction

XRP is down more than 10% from Sunday’s high of $2.03 to today’s intraday low of $1.85.

This drop saw XRP price lose the key levels: The psychological level at $2 and the 100-week exponential moving average (SMA) at $1.87. The 97% uptick in daily trading volume to $3.86 billion reinforces the intensity of the sell-side pressure as traders turned bearish.

A key area of interest lies within the $1.85 (today’s low) and $1.80 (the November 21 low), which, if lost, would trigger another cascade of long liquidations, with local lows at $1.61 being the next area of interest.

Below that, the 200-day EMA $1.38 could be a safe haven for the bulls, where they could take a breather and regroup before making another attempt at recovery.

XRP/USD weekly chart. Source: TradingView

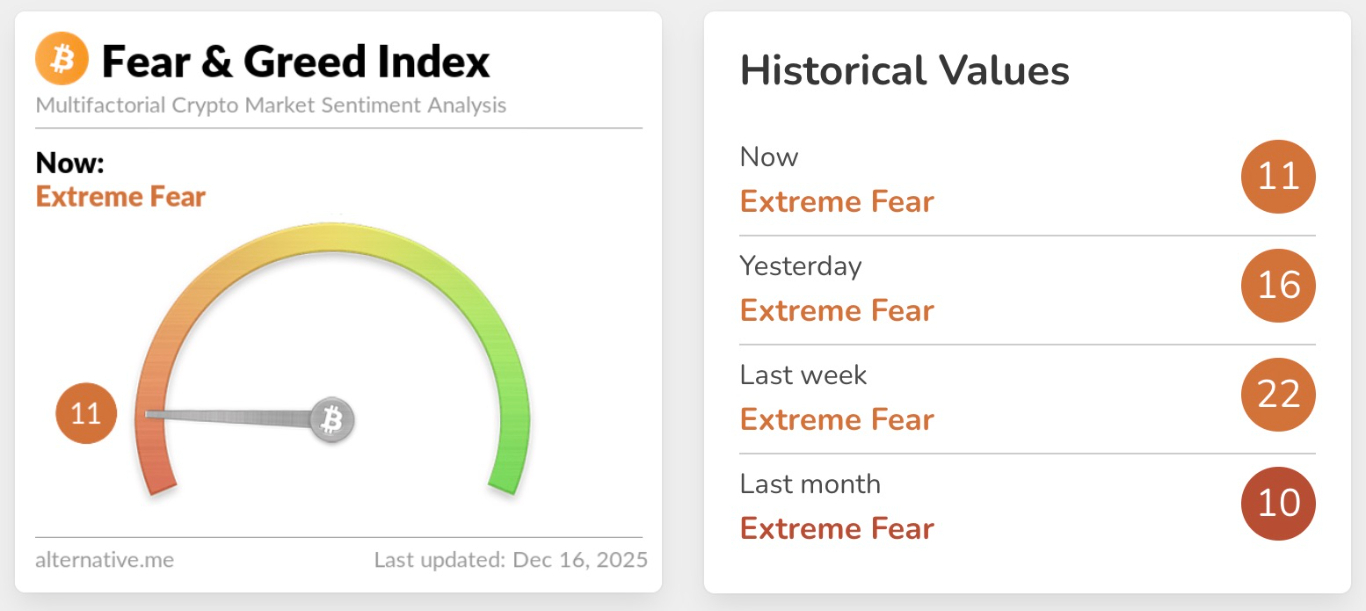

Meanwhile, the Crypto Fear and Greed index has now slipped into the “extreme fear” zone, an area it has held since mid-November, suggesting that the market conditions still favour the downside.

Crypto fear and greed index. Source: Alternative.me

December is typically a bearish month for XRP, according to data from Crypt Rank, and with the current market drawdown, fears are rising that what has long been known as an ‘Santa Rally’ could bring losses for crypto investors even as the Holiday Season draws near.

Ready to trade our analysis of Ripple? Here’s our list of the best MT4 crypto brokers worth checking out.