Short Trade Idea

Enter your short position between $227.69 (a minor horizontal support level) and $233.94 (Friday’s intra-day low).

Market Index Analysis

- Zscaler (ZS) is a member of the NASDAQ 100.

- This index trades inside a bearish price channel with increasing downside momentum.

- The Bull Bear Power Indicator of the NASDAQ 100 is bearish with a descending trendline.

Market Sentiment Analysis

Equity futures are down this morning, building on the rotation out of extremely overvalued AI stocks, as issues from high debt levels to circular financing, and from revenue concerns to valuations, begin to materialize. Today’s focus will be on the delayed October NFP report, expected to show 40,000 job additions with an unemployment rate of 4.4%, while Thursday’s CPI report is expected to reveal an annualized inflation rate of 3.1%. Investors hope for a weak enough job market to prompt another interest rate cut, but strong enough to support economic expansion, which creates a risky investment case given stubborn inflation.

Zscaler Fundamental Analysis

Zscaler is a cloud-based cybersecurity company. It continues to make small but strategic acquisitions to grow its product and services portfolio, including international ones.

So, why am I bearish on ZS despite its 30%+ correction?

Despite its 30%+ correction, valuations are excessive and do not reflect economic reality. While ZS beat on revenues and EPS in its latest earnings report, operating losses increased, and Zscaler delivered a disappointing full-year EPS outlook. Its revenue growth is impressive, but until it can translate it into net earnings, my bearish narrative remains intact. I am also worried about Zscaler’s competitiveness, which could slow its revenue growth, the sole bright spot in an otherwise dismal operational performance.

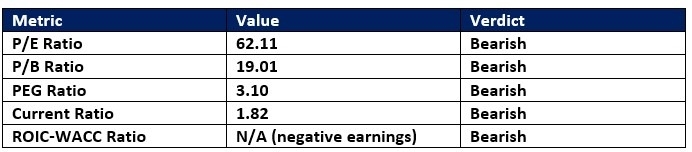

Zscaler Fundamental Analysis Snapshot

The forward price-to-earnings (P/E) ratio of 62.11 makes ZS an expensive stock. By comparison, the P/E ratio for the NASDAQ 100 is 34.13.

The average analyst price target for ZS is $327.44. While it suggests excellent upside potential, downside risks remain elevated.

Zscaler Technical Analysis

Today’s ZS Signal

- The ZS D1 chart shows price action inside a bearish price channel.

- It also shows price action below its ascending Fibonacci Retracement Fan.

- The Bull Bear Power Indicator has been bearish for four weeks with a descending trendline.

- The average bearish trading volumes are higher than the average bearish trading volumes.

- ZS corrected notably more than the NASDAQ 100 bounced higher, a significant bearish development.

Top Regulated Brokers

My Call on Zscaler

I am taking a short position in ZS between $227.69 and $233.94. I remain bearish as valuations remain sky-high, while operating losses increase. I am also worried about its revenue growth rate amid a lack of competitiveness.

- ZS Entry Level: Between $227.69 and $233.94

- ZS Take Profit: Between $164.78 and $172.85

- ZS Stop Loss: Between $256.33 and $262.61

- Risk/Reward Ratio: 2.20

Ready to trade our analysis of Zsaler? Here is our list of the best stock brokers worth reviewing.