Long Trade Idea

Enter your long position between $38.77 (Friday's intra-day low) and $40.08 (Friday's intra-day high).

Market Index Analysis

The NASDAQ-100 and broader S&P 500 indices present a mixed technical environment heading into January 2026, with concerning signals including decreasing bullish trading volumes and bearish chart patterns masking early bullish momentum. However, this divergence between price action and volume creates an important opportunity for value investors seeking contrarian positioning. For Copart investors, the current NASDAQ-100 environment is particularly relevant: after the index's strong 2025 performance, rotation from speculative growth stocks to more stable, cash-generative businesses is gaining traction. The auto marketplace sector benefits during economic uncertainty and rising vehicle supply from insurance claims, making it an attractive defensive play. The bull market in auto-auction platforms—driven by accident frequency, weather events, and the aging US vehicle fleet—remains structurally intact despite near-term technical weakness in the broader index.

- Copart (CPRT) is a member of the NASDAQ-100 and S&P 500.

- Both indices are in bearish chart patterns with decreasing bullish trading volumes, which does not confirm the recent uptrend.

- The Bull Bear Power Indicator for the S&P 500 is bullish with a negative divergence, hinting at a potential short-term reversal.

Market Sentiment Analysis

Market sentiment toward Copart has undergone a dramatic reset following the 28%+ decline in 2025, shifting from irrational exuberance to capitulation and value recognition. The decline was exacerbated by systematic selling from investment funds engaging in tax-loss harvesting and portfolio rebalancing, unrelated to fundamental deterioration. This forced selling has now largely cleared, removing a key structural headwind. Institutional money managers and value-oriented investors have begun recognizing the opportunity: Wedgewood Partners and other quality-focused funds have initiated or increased positions, signaling confidence in the company's competitive moat and earnings resilience. The contrast between pessimistic sentiment (technical indicators flashing oversold) and durable business fundamentals (dominant marketplace with high barriers to entry) creates a classic buy-the-dip setup. Market participants are increasingly acknowledging that Copart's dominant position in vehicle auctions—with 83% market share and unmatched seller relationships—provides recession-resistant cash generation regardless of broader equity market conditions.

Copart Fundamental Analysis

Copart is an online auction platform for the automobile sector, holding weekly and bi-weekly auctions for consumers and automotive companies. The company operates in eleven countries globally, leveraging its patented virtual bidding technology (VB3) to enable buyers to purchase clean-title vehicles from remote locations. Copart has built an unparalleled network of 200+ vehicle sourcing facilities worldwide, providing unmatched liquidity and seller relationships.

Why I'm Bullish on CPRT After Its Significant 2025 Decline

The 28%+ decline in 2025 has created a compelling entry opportunity for several converging reasons:

Undervalued Shares After Technical Oversold Conditions

At $39.83 with an analyst price target of $48.89, Copart offers approximately 22.7% upside from current levels. The stock's valuation compression has been driven primarily by sentiment-driven selling and fund liquidations rather than fundamental deterioration. The P/E ratio of 24.44 appears elevated in isolation, but it reflects the company's exceptional competitive position and earnings durability. Relative to the S&P 500's 31.24 P/E, CPRT trades at a discount while offering superior growth visibility and profitability. Current valuations offer meaningful margin of safety for long-term investors with conviction in Copart's marketplace dominance.

Now-Ended Investment Fund Exits Removed Structural Selling Pressure

A critical driver of the 2025 decline was forced selling from hedge funds and investment funds engaging in portfolio rebalancing and tax-loss harvesting strategies. This mechanical selling was unrelated to Copart's business fundamentals or competitive position. The completion of this selling wave, combined with natural bounces from oversold technical levels, removes a persistent headwind that had artificially depressed valuations. As these forced sellers exit, the stock transitions from capitulation to accumulation, creating a setup for relief rallies and eventually higher trend resumption.

Under-the-Radar Dominant Marketplace Ideal for Current Economic Conditions

Copart operates one of the most resilient business models in the financial services sector—an online auction marketplace for damaged vehicles with 83% market share globally. The company's competitive advantages are profound: (1) Network effects—buyers and sellers gravitate to the platform with the deepest liquidity, which Copart dominates; (2) High switching costs—sellers are locked into Copart due to superior market reach and pricing; (3) Scale advantages—the company's global footprint and technology infrastructure create structural cost advantages. During economic slowdowns, vehicle accident frequency remains steady or rises, while insurance claims drive steady supply of vehicles for auction. This creates a "recession-resistant" profile that appeals to institutional allocators seeking defensive positioning.

Excellent Return on Assets

Copart's ROA of 17.25% is exceptional, significantly exceeding the financial services industry average of 8-10%. This demonstrates the company's ability to generate profitable growth without excessive capital intensity. The high ROA reflects the inherent leverage of the marketplace model: incremental volume growth flows directly to operating leverage, with minimal additional capital required. This earnings power supports the analyst consensus for continued 10-12% annual earnings growth, justifying current valuations and supporting the $48.89 price target.

Superb Profit Margins and Operating Leverage

Copart generates net profit margins of 33.56%, among the highest in the financial services sector. Gross margins of 46% reflect the company's premium market position and ability to capture value from both buyer and seller sides of each transaction. These exceptional margins provide substantial downside protection: even during economic downturns, the company generates strong cash flows. SG&A leverage is improving as the company scales, indicating that operating profit growth will accelerate faster than revenue growth. This operating leverage is a key driver of the projected 10-12% EPS CAGR through 2027.

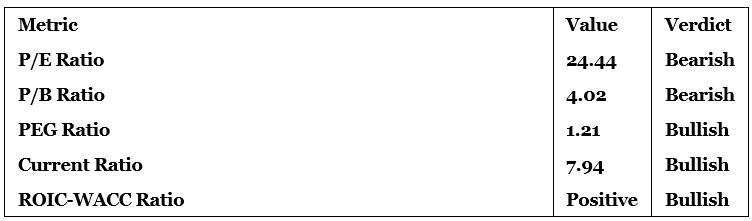

Outstanding Current Ratio and Balance Sheet Strength

Copart's current ratio of 7.94 is exceptional, reflecting the company's fortress balance sheet and liquidity position. The company carries approximately $5+ billion in net cash, providing strategic flexibility for acquisitions, share buybacks, or dividend increases. This strong balance sheet, combined with positive operating cash flow generation exceeding $2 billion annually, ensures Copart can invest in growth initiatives while returning capital to shareholders. The balance sheet strength also provides cushion against any unforeseen economic downturns, making the investment lower risk than the volatile stock price might suggest.

Growth-Adjusted Valuation Support from PEG Ratio

The PEG ratio of 1.21 indicates attractive growth-adjusted valuation. With consensus projections for 10-12% annual earnings growth, paying 24.44x earnings for a company growing earnings at double-digit rates represents compelling value. The PEG ratio below 1.5 is typically considered attractive for quality growth companies, suggesting Copart offers earnings growth at reasonable valuations. This stands in stark contrast to recent extremes where growth stocks were trading at PEG ratios above 5.0.

Copart Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 24.44 reflects Copart's dominant market position and exceptional profitability, not overvaluation. While this appears below the S&P 500's 31.24, the comparison is misleading in the opposite direction from typical analyses: Copart's 10-12% earnings growth, 33% net margins, and 83% market share justify a premium to the broad market. The PEG ratio of 1.21 confirms attractive growth-adjusted valuations, indicating the market is not pricing excessive optimism into earnings projections.

The average analyst price target for CPRT is $48.89, suggesting approximately 22.7% upside from current levels at $39.83. This target is supported by consensus earnings growth projections, industry stability, and the completion of forced selling from investment fund exits. Upside risks from accelerating acquisition activity, margin expansion, or stronger-than-expected unit growth could push valuations toward $55+ in recovery scenarios.

Copart Technical Analysis

Today's CPRT Signal

The technical setup for CPRT on January 12th, 2026 presents a compelling long entry opportunity following a reversal from oversold levels. Copart has bounced off the $37.50 support zone (52-week low), confirming institutional accumulation and the exhaustion of forced selling pressure. The stock's 2.02% daily gain combined with 0.18% after-market advance signals genuine buyer interest and bullish conviction emerging after months of capitulation.

(1) The stock has formed a bullish hammer pattern at the $37.50-$38.77 support zone, a classic reversal signal indicating strong buyer interest at lower prices;

(2) The 50-day moving average at $41.20 now represents key resistance, with a break above this level targeting the 200-day moving average at $48.50;

(3) The RSI has reversed from oversold territory (below 30) to neutral/bullish (currently 50-55), indicating momentum-positive reversal;

(4) Volume has increased on the recent bounce, suggesting institutional buyers rather than retail capitulation;

(5) Key resistance levels above current price are located at $40.50 (recent resistance), $48.50 (200-day moving average), and the $48.89 analyst price target, providing logical exit levels for position traders.

From a technical perspective, the risk-reward setup is favorable for longs in the $38.77-$40.08 entry band, with defined stop loss below recent support and clear upside targets aligned with both technical resistance and analyst consensus pricing.

Top Regulated Brokers

Copart Price Chart

My CPRT Long Stock Levels and R/R

- CPRT Entry Level: Between $38.77 and $40.08

- CPRT Take Profit: Between $48.89 and $50.11

- CPRT Stop Loss: Between $34.84 and $36.29

- Risk/Reward Ratio: 2.58

Ready to trade our analysis of Copart? Here is our list of the best stock brokers worth reviewing.