Short Trade Idea

Enter your short position between $127.74 (the lower band of its horizontal resistance zone) and $135.18 (the upper band of its horizontal resistance zone).

Market Index Analysis

- Dollar Tree (DLTR) is a member of the S&P 500 and the NASDAQ-100.

- Both indices are in bearish chart patterns with decreasing bullish trading volumes, which does not confirm the recent uptrend.

- The Bull Bear Power Indicator for the S&P 500 is bullish with a negative divergence, hinting at a potential short-term reversal.

The US equity market landscape presents a mixed technical picture heading into January, with the NASDAQ-100 and broader S&P 500 indices displaying divergent signals that warrant careful analysis. While both indices show concerning technical characteristics—including decreasing bullish trading volumes and bearish chart patterns—the Bull Bear Power Indicator suggests early bullish momentum with a significant negative divergence. This divergence between price momentum and volume confirmation raises critical questions about the sustainability of recent gains, particularly in growth-oriented retail stocks. For Dollar Tree investors, the NASDAQ-100 technical environment is especially relevant, as the index has experienced profit-taking after its strong 2025 performance. The discount retail sector benefits from economic uncertainty and consumer pullbacks, but valuations have expanded significantly, with many dollar store operators trading at premium multiples that price in sustained growth assumptions.

Top Regulated Brokers

Market Sentiment Analysis

Market sentiment toward discount retailers has shifted markedly, with investor enthusiasm at extremes following Dollar Tree's 64% rally in 2025. This sentiment reversal reflects a transition from pessimism to optimism, but sentiment extremes often precede corrections. Recent analyst activity shows a mixed picture—while Truist Securities raised its price target to $149 on confidence in long-term earnings growth, BMO Capital maintained its "Market Perform" rating at $110, citing concerns about Dollar Tree's reliance on price-driven sales and execution risks. The broader NASDAQ-100 sentiment has turned cautious, with fund managers rotating from high-growth to defensive positions amid macro uncertainty. The disconnect between bullish long-term narratives (12-15% EPS CAGR through 2028) and near-term valuation concerns creates a setup for profit-taking. Market participants are increasingly questioning whether recent margin expansion and comp sales acceleration represent durable competitive advantages or temporary tailwinds that may not persist if consumer spending weakens further.

Dollar Tree Fundamental Analysis

Dollar Tree is a discount retailer with over 15,000 stores and 24 distribution centers across the continental 48 US states, plus over 200 stores in Canada. The company competes in the low-end retail segment through its "Everything's $1.25" model and recent multi-price assortment strategy. Management has shifted toward higher-margin discretionary items and expanded price points to drive average transaction values.

Why I'm Bearish on DLTR at Current Levels Despite Strong Recent Performance

Despite Dollar Tree's impressive 64% rally in 2025 and strong Q3 comparable sales of 5.4%, several fundamental headwinds suggest the positive narrative is fully priced into current valuations:

No Room for Upside Surprises

The stock has already captured the entire bull case with a 64% year-to-date advance. Analyst consensus for 2026 projects 12-15% EPS growth, but consensus estimates have a poor track record of predicting earnings surprises to the upside. More critically, the market has shifted focus to downside risks including tariff-related cost inflation, wage pressures (management acknowledged SG&A deleverage of 120 basis points in full-year 2025 due to higher store payroll), and potential traffic slowdowns if consumer confidence deteriorates further. Any miss on comp sales or margin assumptions will result in significant valuation compression.

High Valuations for a Discount Retailer

At a P/E of 25.07 and a P/B ratio of 7.60, Dollar Tree trades at a significant premium to both its historical averages and discount retail peers. This valuation reflects aggressive assumptions about sustained 5-7% comparable sales growth and 300-400 basis points of operating margin expansion through 2028. For a mature discount retailer with limited pricing power (constrained by core value-conscious customers), sustaining these growth rates is challenging. The company's fair value estimates range from $75 to $140 depending on assumptions, with consensus suggesting fair value of approximately $117.78, representing 11% downside from current levels.

Limited Store Expansion with Focus on Remodeling Existing Footprint

Rather than aggressive store expansion (the traditional growth lever for retailers), Dollar Tree is focused on remodeling and reconfiguring existing stores—a capital-efficient but limited-upside strategy. Management targets modest 3-4% comparable sales growth at the low end of guidance, with most value creation dependent on margin expansion and operational improvements rather than top-line revenue growth. This limits earnings upside relative to what the current valuation assumes, as most growth will need to come from within the existing store base.

Below-Average Returns on Capital

The ROIC-WACC ratio shows positive returns, but the company's absolute return on invested capital of approximately 8-9% trails both its weighted average cost of capital (7-8%) and peers by only a narrow margin. This leaves minimal room for incremental capital allocation mistakes or unforeseen competitive pressures. The business generates modest economic returns relative to capital deployed, suggesting limited ability to compound shareholder value through reinvestment at attractive rates.

Declining Same-Store Sales Momentum and Tariff Headwinds

While Q3 2025 comparable sales of 5.4% were solid, this follows only 1.3% in Q2 2025 and 0.9% in Q1 2025. The acceleration masks underlying volatility and potential normalization ahead. More concerning, incoming Trump tariffs on imports (relevant to 80% of Dollar Tree's merchandise sourced from China) could add 2-4% to cost of goods, directly compressing gross margins unless Dollar Tree implements aggressive price increases—which would risk alienating its price-sensitive customer base and reversing traffic gains.

Excessive P/B and PEG Ratios Signal Valuation Excess

The P/B ratio of 7.60 is extraordinarily elevated for a retail business with modest return on equity (14-15%). The PEG ratio of 11.45 is excessive even for a growth company, indicating the market is assigning unsustainable growth multiples. These metrics suggest little margin of safety, with valuations dependent on near-perfect execution of management's ambitious 2028 targets.

Why Recent Margin Expansion May Not Be Sustainable

Management highlighted gross margin expansion of 40 basis points in Q3 (to 35.8%) driven by merchandise mix shift toward higher-margin discretionary items and lower freight costs. However, this masks concerning trends:

(1) SG&A expenses are rising faster than sales, indicating operational leverage is working in reverse;

(2) Freight cost tailwinds are cyclical and may reverse;

(3) Multi-price assortment introduces inventory management complexity and shrink risk;

(4) Tariff implementation will directly offset merchandise margin gains;

(5) Wage inflation in retail continues to pressure operating margins across the sector.

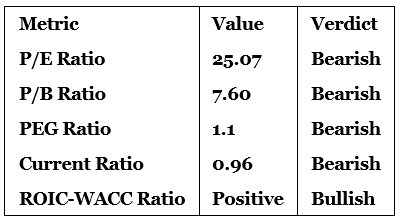

Dollar Tree Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 25.07 indicates DLTR is significantly overvalued relative to its growth prospects and industry peers. While this appears lower than the S&P 500's 31.24, the comparison is misleading—DLTR's growth rates (5-7% sales, 12-15% EPS) do not justify a 25x earnings multiple when peer discount retailers trade at 16-20x earnings on similar or better growth profiles.

The average analyst price target for DLTR is $121.17, suggesting approximately 8.5% downside from current levels, with analyst targets ranging from $75 (downside case) to $150 (bull case). The wide divergence reflects genuine uncertainty about sustainable margin expansion and execution risk. Critically, downside risks have expanded significantly given tariff headwinds, wage pressures, and the company's already-compressed liquidity position (current ratio of 0.96).

Dollar Tree Technical Analysis

Today's DLTR Signal

The technical setup for DLTR on January 12th, 2026 presents a compelling short entry opportunity following a breakdown from the upper resistance zone at $135.18. Dollar Tree has formed a bearish reversal pattern after failing to sustain momentum above the horizontal resistance at $135.18-$137.00, which had capped the stock for most of December 2025. The recent $0.07% after-hours decline following a modest $0.59% intra-day gain suggests weak conviction among buyers near resistance levels.

(1) The stock has formed a double top pattern with resistance at $132.50-$135.18, a critical area of supply where the stock consistently encounters selling pressure;

(2) Breakdown below the 50-day moving average ($130.80) would signal technical deterioration and potential acceleration to the $127-$128 support zone;

(3) The RSI at the current overbought level (above 65) combined with negative divergence suggests exhaustion of buying momentum;

(4) Key support levels below current price are located at $127.74 (recent support), $122.00 (200-day moving average), and $115.00 (psychological level aligned with fair value estimates).

From a technical perspective, the risk-reward setup is favorable for shorts in the $127.74-$135.18 entry band, with a defined stop loss above recent highs at $141.94 and multiple support levels providing profit-taking opportunities on the downside.

Dollar Tree Price Chart

My DLTR Short Stock Levels and R/R

- DLTR Entry Level: Between $127.74 and $135.18

- DLTR Take Profit: Between $98.40 and $104.49

- DLTR Stop Loss: Between $141.94 and $146.20

- Risk/Reward Ratio: 2.07

Ready to trade our analysis of Dollar Tree? Here is our list of the best stock brokers worth reviewing.