Analysts are now focusing on the long-term technical zones and onchain indicators which might signal a major turning point for SOL.

SOL Drops with Broad Crypto Market

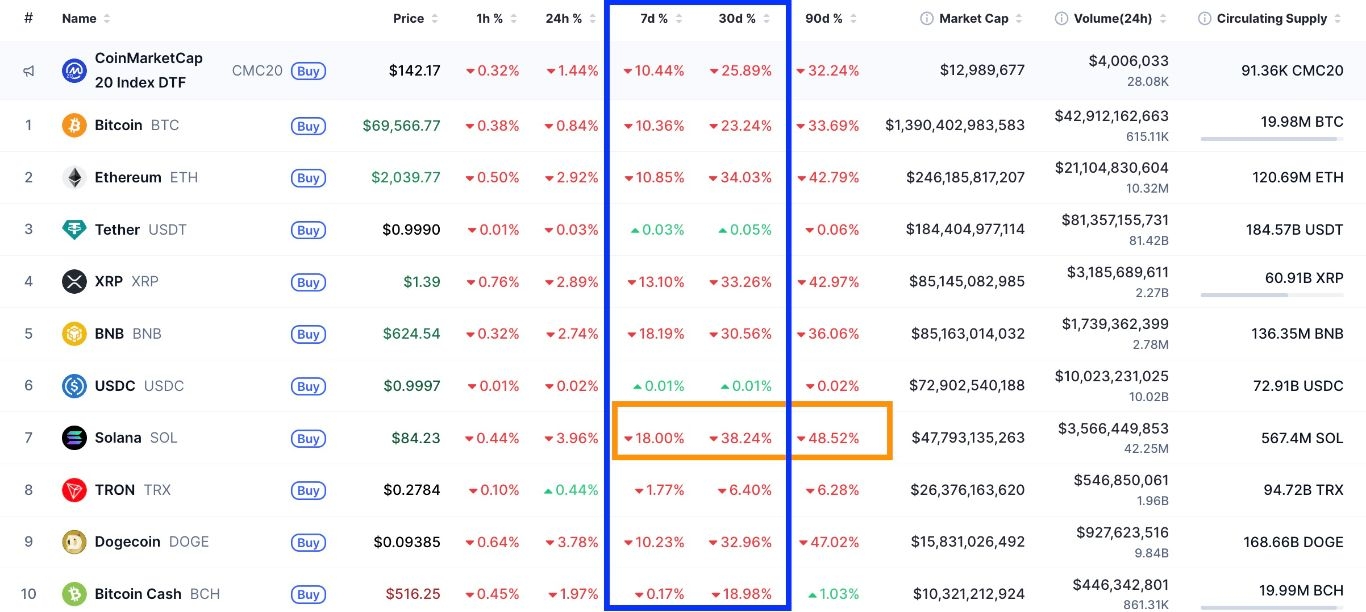

The SOL/USD pair dropped below $70 for the first time since December 2023, falling to a 26-month low of $67 on Feb. 6. While Solana’s price has since recovered to $84 at the time of writing, it has recorded the largest monthly drawdown at 38% among the top-capped cryptocurrencies.

Bitcoin (BTC), the market leader, is trading at $69,566, down 10.4% over the last seven days and 26% in the past month. Second placed Ether (ETH) has lost more than 23% over the last month to trade just above $2,000. XRP (XRP) has also posted significant losses among the top 10 cryptocurrencies, 33% off over the same period.

As a result, the global crypto market capitalization is down 20% over the week and 23.6% over the last 30 days to rest at $2.37 at the time of writing on Monday, February 9, 2025.

Solana’s bearishness over the last week was accompanied by significant long liquidations totaling $295 million over the last seven days, signaling strong downward pressure.

The intensity of the selling pressure was reinforced by declining demand for US-based spot Solana ETFs, which recorded $12 million in outflows on Friday, the largest on record.

Compounding the issue is the dramatic plunge in open interest, which fell by 40% from 2026 peak levels of $8.8 billion in January to about $5.22 billion currently—a staggering $3.6 billion drop that signals waning trader conviction.

This metric, representing the total value of outstanding futures contracts, has declined 4.6% in the last 24 hours alone, reflecting reduced leverage and participation.

In addition, the long/short ratio for SOL hovers near parity at 49.96%/50.04%, indicating balanced but cautious positioning. Analysts attribute this to profit-taking from its latest recovery to $90, leaving Solana exposed as altcoin liquidity evaporates.

How Low Can SOL Price Go?

Solana’s bearishness over the last month has seen it lose two key support levels including the 200-week simple moving average (SMA) and the $100 psychological level.

The last time SOL decisively dropped below the 200-week SMA was in March 2025 and that was followed by a further 45% drop in price.

Solana’s price confirmed the breakdown of a head-and-shoulders (H&S) pattern on January 30, as shown in the chart below.

A head and shoulders pattern is a classic reversal pattern in technical analysis signaling a potential trend change from bullish to bearish. It consists of three peaks: a left shoulder (high), a higher head (peak), and a right shoulder (similar height to left).

The pattern was confirmed when SOL price produced a daily candlestick close below the neckline (support connecting the lows between shoulders) at $120.

The bearish target of the H&S pattern, often measured by targeting a drop equal to the head’s height from the neckline, is at 55. This would represent a further drop of 34% in SOL price.

This level aligns with the bearish target of an inverse V-shaped pattern at $1,385, representing a 28% drop from the current price.

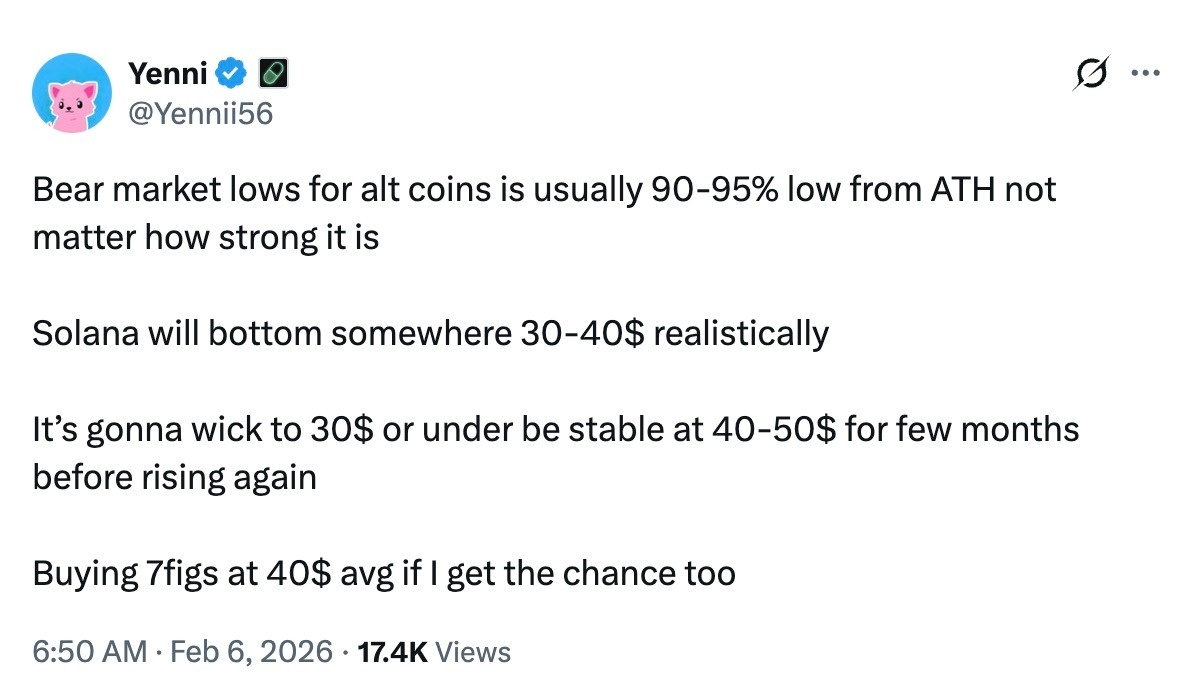

Popular analyst Yenni said the SOL/USD pair could go as low as $40, representing a 90%-95% drawdown from its all-time high, which is a common phenomenon in altcoins.

Ready to trade our analysis of Solana? Here’s our list of the best MT4 crypto brokers worth checking out.

Ready to trade our analysis of Solana? Here’s our list of the best MT4 crypto brokers worth checking out.