Get the Forex Forecast using fundamentals, sentiment, and technical positions analyses for major pairs for the week of July 4, 2022 here.

The following are the most recent pieces of Forex technical analysis from around the world. The Forex technical analysis below covers the various currencies on the market and the most recent trends, technical indicators, as well as resistance and support levels.

Most Recent

Start the week of July 4, 2022 with our Forex forecast focusing on major currency pairs here.

The Euro has bounced from a major support level to show signs of life yet again.

Top Regulated Brokers

The S&P 500 has been all over the place during the trading session on Thursday, as it was the end of the month and of course, rebalancing occurs.

The British pound has rallied a bit during the trading session on Thursday, reaching near the 1.22 level.

The West Texas Intermediate Crude Oil market has fallen during trading on Thursday to break through a trendline.

The NASDAQ 100 has gone back and forth during the bulk of the trading session on Thursday, which should not be a huge surprise considering that it was the end of the month’s rebalancing

Ethereum has fallen yet again during the trading session on Thursday as it looks like we are going to threaten the $1000 level.

The Bitcoin market has fallen again during the trading session on Thursday to break back below the $20,000 level.

Bonuses & Promotions

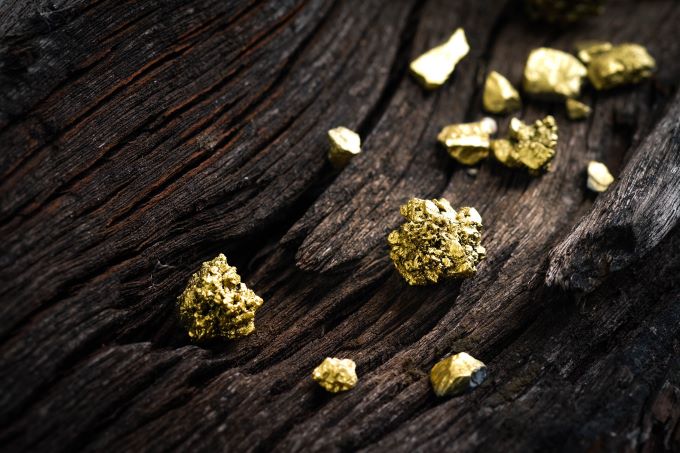

Gold markets have been all over the place during trading on Thursday, initially breaking through a major uptrend line

The Australian dollar looked as if it was going to break down during the trading session on Thursday but turned around and bounced rather hard from the 0.6850 region.

The German DAX fell really hard to kick off the trading session on Thursday, crashing into a support area just above the €12,500 level before bouncing almost €300.

The US dollar returned to its strong upward trajectory amid increasing expectations of the chances of raising US interest rates strongly during 2022.

The British pound incurred broad losses earlier this week and there were strong indications, that the breadth and depth of its declines resulted from an apparently successful attempt by the Swiss National Bank to defend the Swiss Franc from a strong US dollar.

Despite the announcement of a stronger-than-expected contraction of the US economy, forex traders ignored the statement and continued to react to the collapse of the Japanese yen rate in the exchange market.

.jpeg)