Bitcoin tests the critical $120,000 level, with a confirmed breakout potentially opening the path to $130,000 while $114,000 holds as key support.

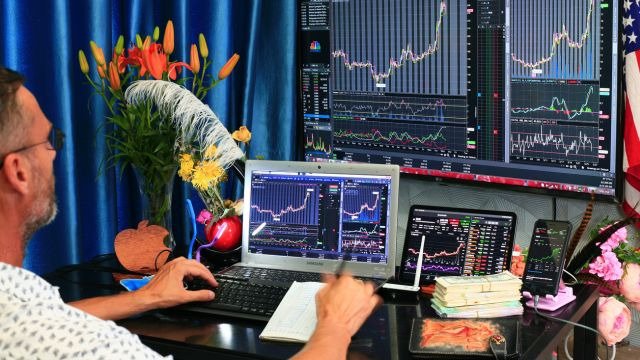

The following are the most recent pieces of Forex technical analysis from around the world. The Forex technical analysis below covers the various currencies on the market and the most recent trends, technical indicators, as well as resistance and support levels.

Most Recent

USD/JPY tests the key ¥150 level and 200-day EMA, with traders eyeing US CPI data that could determine the next move in Fed policy and dollar strength.

Gold prices stay strong above $3,378 support as tariff tensions, central bank demand, and bullish technicals keep $3,500 in focus.

Top Regulated Brokers

EUR/USD consolidates near 1.1640 with technicals hinting at an early bullish turn, but US CPI data and tariff risks could set the next big move.

USD/MXN trades near 18.55 key support ahead of US CPI, with a break lower potentially confirming extended mid-term downside in the pair.

USD/CAD hovers near 1.3750 support-turned-resistance after soft Canadian jobs data, with the 50-day EMA and rate gap favoring further USD gains.

Nvidia is approaching a key $185 breakout level, with bullish momentum aiming for $197, while $170 and the 50-day EMA remain key supports.

The euro continues to consolidate above 1.16, with potential to reach 1.18 if it clears 1.17, but a drop under the 50-day EMA could revisit 1.14 support.

GBP/USD trades just above the 50-day EMA, targeting 1.3550 resistance, while a break under 1.33 could trigger a move toward the 200-day EMA.

Bonuses & Promotions

The NASDAQ 100 is advancing toward 24,000, with dips expected to attract buyers near 23,250 or the 50-day EMA despite low-volume summer trading.

NZD/USD faces selling pressure near the 50-day EMA, with risk skewed toward 0.5850 unless bulls break 0.60 resistance in thin summer trading.

EUR/JPY is consolidating in a bullish flag near 170 support, with upside potential toward 175–182 if 173 breaks, but downside risk to 166 if support fails.

The USD/MXN pair hovers near key 18.50 support, with a potential break targeting 17.70, supported by Mexico’s favorable rates and tariff extension optimism.

Declining dividend yields and a high debt-to-equity ratio flash warning signs. After giving up its post-earnings rally, price action completed a breakdown. What’s next for this banking stock, and how should you approach it?

Value destruction and declining profit margins are two red flags. Balance sheet issues flash more warning signs, and rising competition adds to business risks. Is more downside ahead following a significant breakdown?