EUR/USD remains range-bound near 1.04100, with traders watching the ECB’s expected rate cut and U.S. economic data for potential shifts in sentiment.

The following are the most recent pieces of Forex technical analysis from around the world. The Forex technical analysis below covers the various currencies on the market and the most recent trends, technical indicators, as well as resistance and support levels.

Most Recent

USD/JPY continues to find buyers on dips, with strong support near 155, as the Fed’s higher rates contrast with Japan’s dovish stance.

NASDAQ 100 trades sideways between 21,000 and 22,000, as traders assess tech earnings and AI concerns while looking for buying opportunities on dips.

Top Regulated Brokers

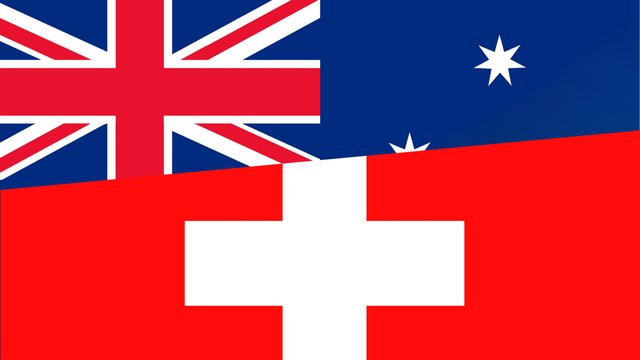

AUD/CHF finds support at 0.5650, with potential upside toward 0.5750–0.5800, though technical barriers like the 200-day EMA may limit gains.

The Dow Jones 30 continues to push higher, with traders eyeing a breakout above 45,100 for a potential move toward 46,000 amid strong market sentiment.

USD/CAD stays in consolidation, with 1.45 as key resistance and 1.43 as support, as traders assess U.S.-Canada trade risks and central bank divergence.

EUR/USD remains range-bound between 1.03 and 1.05, with traders fading rallies as uncertainty over ECB and Fed policy keeps the pair in consolidation.

Bitcoin continues its uptrend, with traders accumulating near $100K while watching for a breakout above $110K to signal the next major move.

Nifty 50 struggles to gain momentum, with 23,400 as key resistance, while long-term growth prospects remain strong despite inflation concerns.

Bonuses & Promotions

Ripple consolidates near $3, with traders watching for a breakout above $3.40 or a pullback to $2.20 as market momentum builds.

USD/CHF tests 0.91 resistance, with bullish momentum likely to continue amid Fed-SNB policy divergence, making pullbacks attractive buying opportunities.

EUR/USD holds steady near 1.0415 as markets anticipate the ECB’s policy update, with resistance at 1.0560 and a break below 1.0330 signaling further downside.

Gold remains near record highs at $2757, with traders eyeing $2766 resistance and US economic data for further direction amid Fed policy uncertainty.

GBP/USD attempts a rebound but remains below key resistance, with traders watching US economic data for clues on the pair’s next move.

USD/JPY continues its recovery from 153.71 support, with bulls targeting 156.80 and 158.00, while traders monitor US economic data for further momentum.