CAD/JPY rallies sharply, with yen weakness driving the move, as traders watch for value near 108.00 or a breakout above 111.50 for further upside.

The following are the most recent pieces of Forex technical analysis from around the world. The Forex technical analysis below covers the various currencies on the market and the most recent trends, technical indicators, as well as resistance and support levels.

Most Recent

Ethereum stabilizes at $3600, with potential to target $4000 if momentum builds, while $3500 and $3000 levels act as key support zones.

USD/CHF pulls back to 0.8950, holding support as diverging Fed and SNB policies favor further upside in the pair amid bullish momentum.

Top Regulated Brokers

Bitcoin stabilizes at $100K, maintaining bullish momentum as traders watch for a breakout above recent highs or further dips to $95K as buying opportunities.

USD/CAD pulls back below 1.44, with bullish momentum remaining strong as traders watch for buying opportunities amid Canada’s economic challenges.

USD/JPY breaks above 156.50, driven by BoJ inaction and Fed-related volatility, with bullish sentiment dominating despite seasonal market expectations.

The USD/INR jumped to new record high values early today and the 85.0000 ratio has been penetrated making this level a worthwhile consideration for speculators and financial institutions.

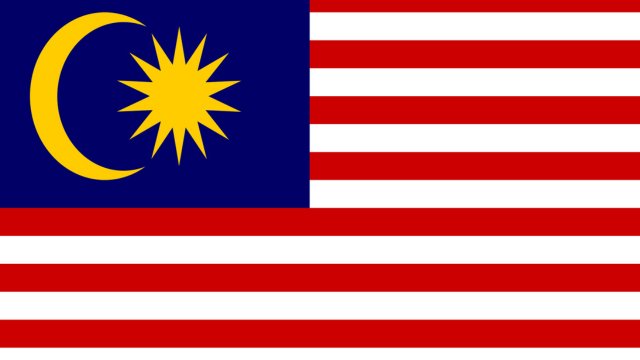

The USD/MYR climbed quickly as a response to the U.S Fed’s more hawkish sounding rhetoric than expected late yesterday, the USD/MYR is trading at values now last seen in the first week of August this year.

The US Dollar has rallied significantly during the trading session on Wednesday after the FOMC meeting.

Bonuses & Promotions

The US dollar initially rallied against the Malaysian ringgit during the trading session on Wednesday.

The crude oil markets in the United States, the West Texas Intermediate Crude Oil market.

The Turkish lira hits record lows against the USD, with the pair trading above 35.00 as high inflation and external debt pressures weigh on the currency.

EUR/USD hits a two-year low at 1.0343, with political instability and weak Eurozone data fueling parity concerns amid Fed-driven dollar strength.

GBP/USD hits a three-week low at 1.2562 as hawkish Fed signals weigh heavily, while traders await the Bank of England’s key policy announcement.

USD/JPY climbs to a five-month high at 156.68, with bullish momentum fueled by contrasting Fed and BoJ policies, as traders anticipate a push toward 160.00.