The US dollar was very stout during the trading session on Thursday as we have now broken above the crucial 150 yen level.

The following are the most recent pieces of Forex technical analysis from around the world. The Forex technical analysis below covers the various currencies on the market and the most recent trends, technical indicators, as well as resistance and support levels.

Most Recent

In my daily analysis of European markets, the DAX stands head and shoulders above all else when I look at the markets, mainly because it is a major driver of where we go on the continent.

When I look at the European indices during the trading session on Thursday, the FTSE 100 has caught my attention as it is pressuring a major resistance barrier in the form of 8400.

Top Regulated Brokers

During my daily analysis of exotic currency pairs, the USD/MYR pair has caught my attention, as we are currently hanging around a large, round, psychologically significant figure in the form of the 4.30 MYR level.

In my daily analysis of the gold markets, the first thing that comes to mind is that we have just broken out.

The silver market caught my attention during my daily analysis of commodities on Thursday as it continues to show extreme amounts of volatility.

The GBP/USD exchange rate continued its downward trend, falling to its lowest point since August 22nd, and by over 3.35% from its highest level this year.

The EUR/USD exchange rate fell for three straight days, continuing the downtrend that started on 1.1213, when it peaked at 1.1213.

The AUD/USD pair’s crash continued its downward trend ahead of key US economic data. It retreated to a low of 0.6665, its lowest level since September 11 and by over 4% from its highest point this year.

Bonuses & Promotions

The BTC/USD pair has been in a strong bullish trend in the past few days.

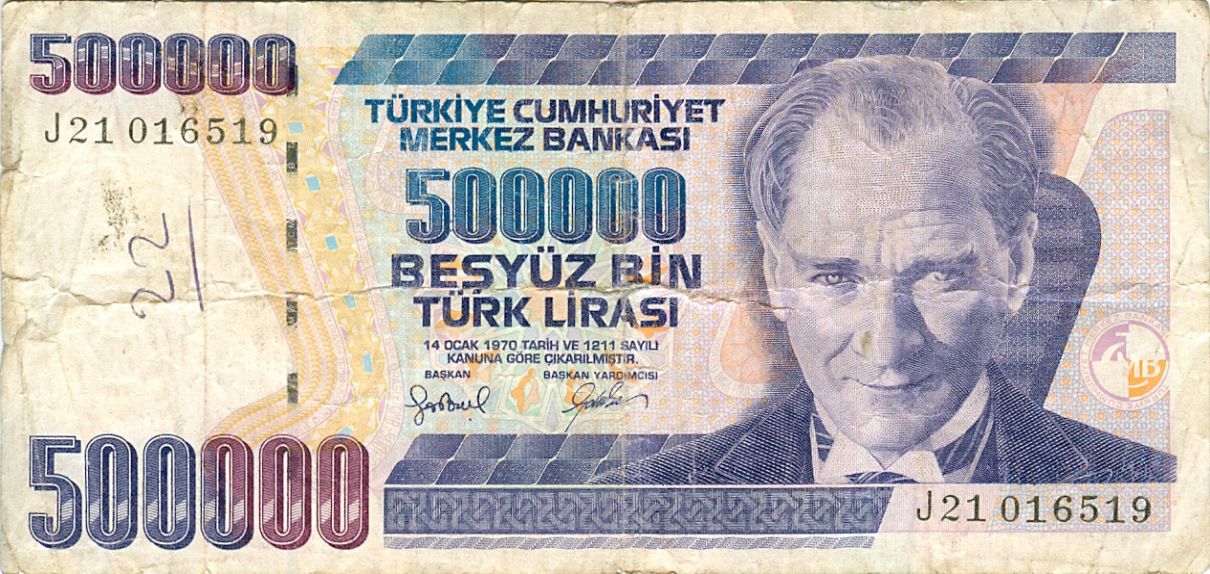

The USD/TRY pair has been trading within a narrow range for several weeks, with the Lira showing a slight upward trend compared to yesterday. Currently, markets

Gold touched the $2685 level on Wednesday, an area that previously was the swing high and the all-time high in the market, but it did retreat from there.

In my daily analysis of the European indices, the FTSE 100 has caught my attention as it has been so strong.

Gold prices surged to around $2,685 per ounce today, Thursday, trading at record highs, as dovish expectations from major global central banks and a slight

During my daily analysis of commodities, the silver market stood out due to the fact that we shot higher, but then gave back some of the gains.