The Aussie dollar went back and forth during the course of the trading session on Thursday as we continue to look for some type of support.

The following are the most recent pieces of Forex technical analysis from around the world. The Forex technical analysis below covers the various currencies on the market and the most recent trends, technical indicators, as well as resistance and support levels.

Most Recent

After five consecutive trading sessions during which the GBP/USD pair was subject to selling starting from the resistance level of 1.3265, its highest level in two years.

The Japanese yen has risen to the brink of the 143.00-yen level against the US dollar, recovering sharply from its two-week low as weak US manufacturing data fuelled recession fears, boosting demand for safe-haven assets.

Top Regulated Brokers

For the second consecutive day, the EUR/USD pair has been attempting to halt its recent losses ahead of a package of important and influential US economic data.

We have often emphasized that buying gold at every dip is the best trading strategy for gold.

The US dollar has done very little during the trading session against the Chinese yuan, as we are hanging around the 7.11 level.

The US dollar initially rallied during Wednesday's session, breaking above the crucial 84 level.

The US dollar has gone back and forth during trading on Wednesday as we continue to hang around the 19.78 level.

The S&P 500 appears to be stabilizing a bit during the trading session on Wednesday as it looks like we are going to continue to see a lot of noisy behavior.

Bonuses & Promotions

The natural gas market initially shot higher during the early hours on Wednesday to test the 200-day EMA but has since been squashed as that technical indicator certainly has brought a lot of sellers back into the market.

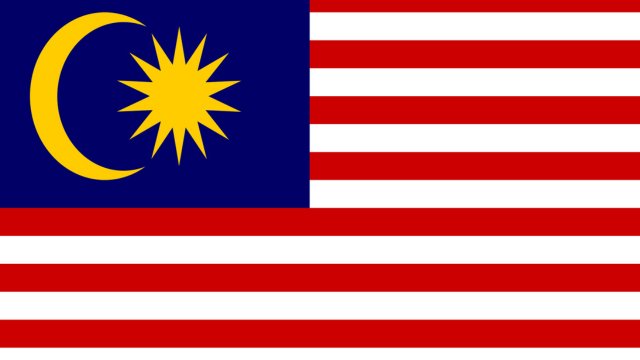

The ability of the USD/MYR to move lower today is noteworthy, because the selling of the currency pair continues to demonstrate financial institutions are leaning into a bearish outlook.

The USD/INR exchange rate remains a difficult currency pair for day traders to speculate on because of India’s government controls on Forex, yet the incremental rise higher remains technically attractive.

The GBP/USD pair has caught my attention as we have turned around to break the top of the hammer from the previous session.

Bitcoin has been declining and looking bearish in line with the general risk-off sentiment dominating capital markets.

The ASX 200 has stood out as an example of a potentially exciting technical analysis set up.