The US dollar has rallied a bit during the trading session on Monday to kick off the week, but at this point, I think the likelihood of anything major happening is probably minuscule.

The most active trading sessions for the USD/JPY take place in Tokyo, London and New York. Day traders look mostly to the London and New York sessions but those trading wishing to trade on the Asian markets can do so between 2400 GMT - 0900 GMT.

USD/JPY has traditionally been the most politically sensitive currency pair, with successive U.S. governments using the exchange rate as a lever in trade negotiations with Japan. For day-to-day trading, the most significant feature of USD/JPY is the heavy influence exerted by Japanese institutional investors and asset managers.

The USD/JPY has recently dipped below 101.00. Read the Daily Forex USD to Japanese Yen forecast and get access to the most up-to-date statistics, analyses and economic events regarding the USD/JPY.

Most Recent

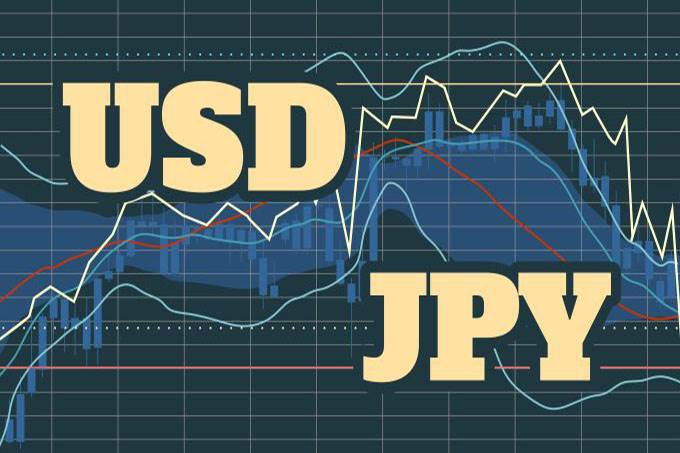

For two weeks in a row, the USD/JPY currency pair was moving in a dull performance in the vicinity of limited levels where it is unable to overcome the 108.00 resistance when preparing to move up.

The US dollar has initially tried to rally during the trading session on Friday but gave back the gains as we got a bit too close to the ¥107.50 level.

Top Regulated Brokers

The US dollar rallied a bit during the trading session on Thursday against the Japanese yen but gave back the gains at the very end of the day.

The US dollar fell rather hard during the trading session on Wednesday as the greenback continues to take it on the chin.

Bears still have stronger control over the USD/JPY performance, as the pair returned to the 106.66 support during yesterday's trading before settling around the 106.93 level at the beginning of Thursday's trading.

The continued monitoring of increasing numbers of new infections with the Coronavirus in the United States, along with the renewed tensions between the two largest economies in the world, are the most important factors that explain the continued downward pressure on the USD/JPY, which is struggling to return to stability above the 108.00 resistance to exit the bearish channel that is in control since the beginning of the current month’s trading.

The US dollar initially rallied during the trading session on Tuesday but gave up some of the gains against the Japanese yen as we continue to see the 107.50 level cause a reaction in this market.

After mentioning in the technical analysis that the USD/JPY pair has reached strong oversold areas, it’s recent levels are the best ones for selling.

Bonuses & Promotions

The US dollar has rallied slightly during the trading session on Monday, as we continue to see the ¥107.50 level act as a bit of magnet for price.

For two weeks in a row, the USD/JPY pair moved in a stable downward correction range below the 108.00 support, and last losses reached the 106.63 support, the lowest level in three weeks, before closing trading around the 106.92 level.

The US dollar has broken down a bit during the trading session on Friday, showing signs of weakness yet again.

The US dollar went back and forth during the trading session on Thursday, as we continue to see a lot of noise in this pair.

As we expected in the previous analysis, the USD/JPY performance of moving in tight ranges for several sessions is awaiting a strong move in one direction or the other and was closer to continue the downtrend as long as it was holding below the 108.00 support.

The US dollar initially rallied during the trading session on Wednesday but as you can see, we have seen a lot of exhaustion above the crucial ¥107.50 level.