For over a decade, DailyForex has been the trusted Forex broker authority, establishing an unrivalled reputation for rigorous research and journalistic integrity. With a methodology refined through years of industry experience, we empower traders to make informed decisions, which is particularly important when trading high-risk investments such as penny stocks. Discover more about our comprehensive review process and how we maintain transparency and impartiality here.

Editor’s Verdict

I have been tracking FXCC since they entered the market in 2010, and their evolution has been fascinating to watch. While so many brokers are busy adding gamified apps or social trading gimmicks, FXCC has doubled down on one thing: driving trading costs as close to zero as possible. Their flagship "ECN XL" account is a disruptor; it offers the raw spreads of an institutional ECN account but removes the commission element entirely.

For this FXCC review, I tested the broker’s execution speeds and spread stability. The results were impressive. You can benefit from the safety of a Tier-1 European license (CySEC) combined with the flexibility of offshore entities, allowing for higher leverage. It is rare to find a broker that offers 0.0 pip spreads without charging a standard $ lot fee, making FXCC one of the most cost-efficient providers to trade with right now.

Overview

In FXCC, I see a broker built for the "pure" trader. They aren't trying to be a Fintech commercial bank or a social network. They are an execution venue first and foremost. The user experience is stripped back and functional, focusing entirely on the MetaTrader (MT4/MT5) environment and a proprietary copy trading platform. The standout feature is undoubtedly the pricing model: by eliminating the commission fee on their raw spread account, they have effectively undercut much of the ECN market.

Cyprus, Comoros CySEC, MWALI International Services Authority 2010 ECN/STP, No Dealing Desk $50 MetaTrader 4 0.0 pips 0.5 pips 0.03$ 0.18$ 60$ 70.00% 0.0 pips 0 no 10+

FXCC Core Takeaways:

- The "Zero" Concept: A unique model offering 0.0 pips and $0 commission on the ECN XL account.

- Safety Meets Flexibility: Regulated in Europe (CySEC) for safety, and the Mwali International Services Authority (MISA) for high leverage.

- Platform Standards: Full support for both MetaTrader 4 and the modern MetaTrader 5.

- Cost Efficiency: No hidden costs on deposits, or withdrawals, just a $5 monthly inactivity fee after 4 months of dormancy

- Asset Growth: Now includes Crypto, Stocks, and Indices alongside core Forex and Commodities.

FXCC Regulation and Security

When it comes to your money, a broker's regulation is everything. FXCC passes with a strong "Hybrid" score. Unlike brokers that have moved entirely to offshore islands, FXCC maintains a foothold in the European Union while expanding its global reach.

Is FXCC Legit and Safe?

Yes, we can be confident in the broker’s legitimacy. They have over 15 years of operational history and physical offices in Cyprus.

The dual-regulation structure allows you to choose your level of protection. Here is the breakdown of its current entities and licenses: Today, FXCC operates under an offshore brokerage framework. Here’s the breakdown of its current entities and licenses:

Name of the Regulator | CySEC, MWALI International Services Authority |

|---|---|

Regulatory License Number | 121/10 (CySEC), BFX2024085 (MISA) 14576 (VFSC) |

Regulatory Tier | 1, 3, 3 |

For traders, this offers a choice: Register under the EU entity for maximum protection (Investor Compensation Fund coverage) or register under the global entity for maximum freedom (1:1,000 leverage and bonuses), knowing the brand is still overseen by a Tier-1 regulator elsewhere.

Who Should Trade with FXCC?

FXCC is very clearly positioned as a specialist broker. Because they have stripped away the add-ons (like social trading networks or extensive learning academies) to focus on price, they are perfect for some types of traders though less ideal for others.

Let’s see which kinds of traders are best suited to FXCC’s offer:

Type of Trader | Rating | Summary |

|---|---|---|

Scalpers & Day Traders | Highly Recommended | The ECN XL model is perfect for high-frequency trading. Paying $0 commission on raw spreads (0.0 pips) significantly boosts net profitability compared to standard brokers |

Algo Traders (EAs) | Highly Recommended | With full support for MT4 & MT5, plus a proprietary copy trading platrform and a free VPS service for active accounts, the infrastructure is built for automated strategies |

Beginners | Neutral / Less Suited | While the $0 minimum deposit is accessible, beginner traders are missing a structured "Trading Academy" or in-depth courses |

US Residents | Not Suited | FXCC does not accept clients from the United States due to regulatory restrictions |

Crypto Traders | Recommended | You can trade major cryptos like BTC and ETH, and FXCC also offers weekend trading |

High Leverage Seekers | Recommended | For experienced traders who understand risk, the MISA entity offers leverage up to 1:1,000, which is much higher than EU-regulated alternatives |

Fees

HOW WE TEST BROKER FEES

At DailyForex, we review broker fees by opening live accounts and trading multiple asset classes to assess spreads, commissions, and overall trading costs. We compare each broker’s fees against industry averages for major currency pairs. We also assess deposit, withdrawal, inactivity, and swap fees, rewarding price competitiveness and transparency. Learn more here.

This is where FXCC truly shines. In my comparison of over 50 brokers over the past year, FXCC’s "ECN XL" model stands out as one of the most aggressive pricing structures available.

Average Trading Cost EUR/USD | 0.0 pips |

|---|---|

Average Trading Cost GBP/USD | 0.5 pips |

Average Trading Cost WTI Crude Oil | 0.03$ |

Average Trading Cost Gold | 0.18$ |

Average Trading Cost Bitcoin | 60$ |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 0 |

Minimum Commission for Forex | no |

Inactivity Fee | true |

The broker operates on a "One Account" philosophy:

- ECN XL Account: You get access to interbank spreads starting at 0.0 pips. However, unlike a standard "Raw" account at other brokers, FXCC does not charge a commission.

EUR/USD Trading Costs Example:

Account Type | Average Spread (EUR/USD) | Commission (Round Turn) | Total Cost per 1.0 Lot |

Standard Broker | ~1.2 pips | $0.00 | ~$12.00 |

Typical ECN Broker | ~0.1 pips | $7.00 | ~$8.00 |

FXCC ECN XL | ~0.1 pips | $0.00 | ~$1.00 |

My Observation: For high-volume scalpers or algorithmic traders, the savings on commission fees add up to significant equity over time.

Noteworthy:

- A $5 a month inactivity fee after 4 months of account dormancy

- Swap fees, applicable on overnight holds (triple swap on Wednesday).

- Zero transaction fees - FXCC absorbs the costs for both funding accounts

Overnight Swaps

Like most Forex brokers, holding a leveraged position overnight will incur a swap fee (or credit). This is essentially the interest rate differential between the two currencies in a pair. These rates can be checked directly within the MT4/MT5 platform.

A great advantage at FXCC is that the broker offers swap-free account options to everyone with no limitations under the same trading conditions - no extra charges or fees are applied. Like other brokers using the Metatrader setup, swaps are increased for trades held open on a Wednesday to account for the weekend break in trade settlement behind the scenes.

Swap Calculation Example:

Let's calculate the estimated cost of buying 1.0 lot of EUR/USD and holding it, assuming the following swap rates:

- Swap Long: -$5.00 per night

- Swap Short: +$1.00 per night

Holding a standard 1 lot EURUSD position for one night:

Direction | Spread Cost | Commission | Swap Cost | Total Cost |

Buy | ~$1.00 | $0.00 | -$5.00 | $6.00 |

Sell | ~$1.00 | $0.00 | +$1.00 | $0.00 |

Holding EURUSD position for seven nights:

Direction | Spread Cost | Commission | Swap Cost (7 nights) | Total Cost |

Buy | ~$1.00 | $0.00 | -$42.00 | $50.00 |

Sell | ~$1.00 | $0.00 | +$10.50 | -$10.50 (Credit) |

Note: These are estimated figures. Actual swap rates vary daily based on interbank interest rates and will be displayed on the MetaTrader platform

Range of Assets

Asset Class | Availability | Examples |

Forex | Yes | 70+ Pairs Majors & Exotics |

Stock CFDs | Yes | Apple, Tesla, Google |

Indices | Yes | US500, GER40, UK100 |

Commodities | Yes | Gold, Silver, WTI Crude Oil |

Cryptocurrencies | Yes | BTC/USD, ETH/USD, XRP/USD |

FXCC has successfully transitioned from a "Forex only" shop to a multi-asset broker. The recent inclusion of spot stocks and cryptocurrencies has rounded out their offer significantly.

Cryptocurrencies | |

|---|---|

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

FXCC Leverage

Leverage at FXCC is dynamic and depends entirely on which entity you register with.

- Global Clients (MISA): Access leverage up to 1:1,000. This allows you to control large positions with relatively small capital, though it increases risk.

- European Clients (CySEC): Capped at 1:30 to comply with ESMA consumer protection rules.

What Should Traders Know about FXCC Leverage?

- Magnified Risk: High leverage amplifies both potential profits and potential losses. A small market movement against your position can result in significant losses.

- Protection: FXCC guarantees Negative Balance Protection (NBP) for all clients, meaning you cannot end up owing the broker money if the market gaps.

- Asset Limits: Leverage is lower for more volatile assets like crypto (typically 1:10 or 1:20).

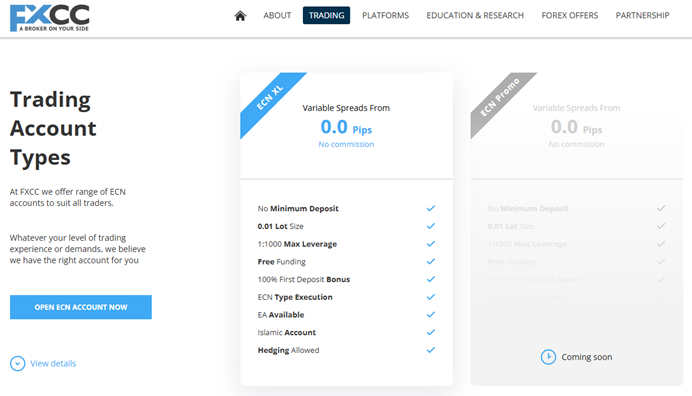

Account Types

I appreciate FXCC's refusal to complicate things. There are no confusing "Gold" or "Platinum" tiers that hide better spreads behind $10,000 deposits.

- ECN XL Account:

- Minimum Deposit: $0 ($100 recommended)

- Spread: Raw (from 0.0)

- Commission: None

- Access: All traders get the same institutional pricing.

- Islamic Account: 100% Sharia-compliant Swap-Free accounts are available.

FXCC Demo Account

The FXCC Demo Account is an excellent tool. It comes pre-loaded with virtual funds and does not expire as long as you login occasionally. I recommend running it side-by-side with a standard broker to see the difference in spread costs – the spreads in the demo account are realistic.

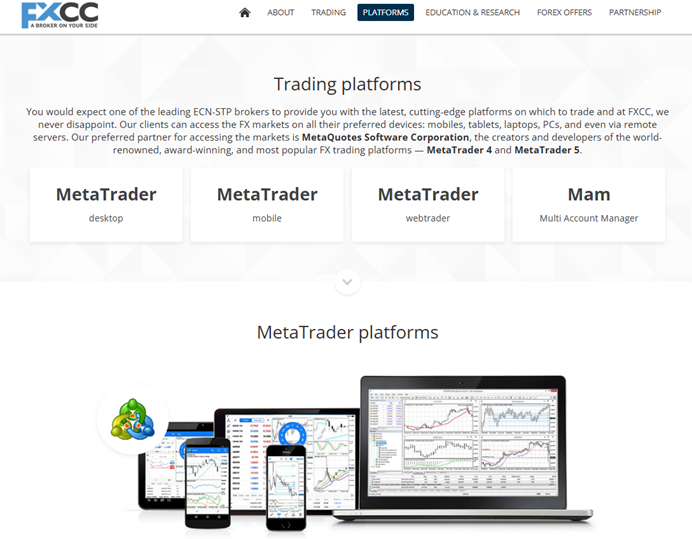

Trading Platforms

Alongside its proprietary copy trader, FXCC sticks to the "Gold Standard" duo. If you have traded on Meta before, you will feel right at home:

- MetaTrader 4 (MT4): The king of Forex trading. It is lightweight, stable, and supports thousands of third-party EAs (Expert Advisors).

- MetaTrader 5 (MT5): The necessary upgrade for modern markets. I recommend using MT5 if you plan to trade stocks or crypto, as it offers better depth-of-market tools and timeframes.

- FXCC Copy: A proprietary platform providing a first-class copy trading service.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

What I'd Like FXCC to Add

Despite the excellent pricing, there is room for improvement with the addition of a proprietary mobile app: A sleek, branded app for checking positions on the go (outside of the MT4/5 mobile app) would modernise the experience.

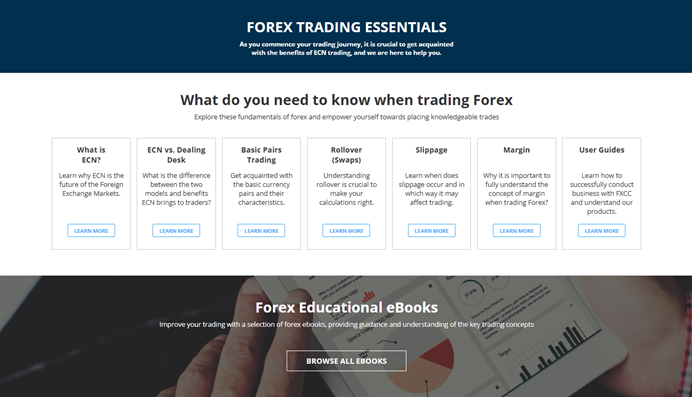

Research & Education

The educational offering is functional but lean. All the basic trading information for beginners is available but for advanced trading methodologies, traders may want to look elsewhere. I do like the wide range of free eBooks covering certain elements essential for successful traders like managing mindset. On the research side you will find a Daily Technical Analysis blog and a standard Economic Calendar. While the content is accurate, it lacks the depth of premium market sentiment tools or live webinars found at larger competitors.

Customer Support

Support is available 24/5, covering the global markets from open to close.

- Live Chat: Responsive and human

- Email: Reliable for non-urgent queries

- Phone: Direct lines for immediate assistance

The service is solid, but the lack of weekend support is a slight disadvantage in the era of 24/7 crypto markets.

Support is available in English, Spanish, Arabic, Chinese, Russian, Portuguese, and more.

Bonuses and Promotions

At the time of this review, FXCC leverages its global entity to offer incentives that EU brokers cannot. Currently, they are running a 100% First Deposit Bonus. This credit boosts your available margin, allowing you to sustain positions through temporary drawdowns. Obviously, this comes with the usual conditions attached. You cannot withdraw these funds; they can be used for margin trading purposes only.

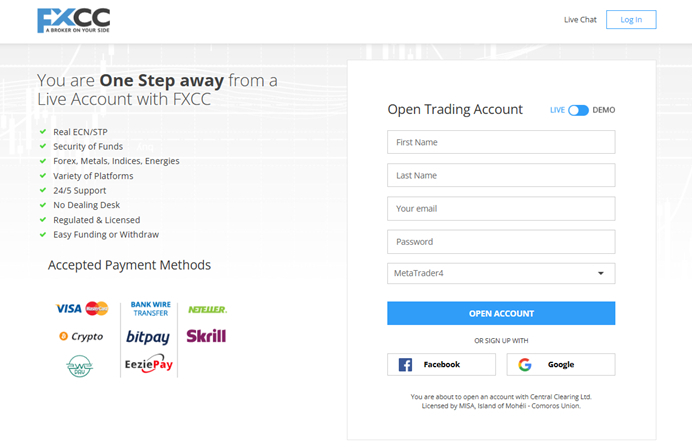

Opening an Account

The account opening process is fully digital and follows industry standards.

What should traders know about the FXCC account opening process?

- Register: Complete the online application form with your personal details. FXCC allows traders to sign up as individuals or register a company.

- Verify: Submit KYC (Know Your Customer) documents. This typically includes a government-issued ID (like a passport or driver's license) and proof of address (like a utility bill or bank statement).

- Fund: Once verified, you can fund your account using one of the available methods.

The process is generally quick and can often be completed on the same day. I like that you can sign up using your Facebook or Google account. Check on the signup page to ensure you are onboarding with the correct entity for your location.

Minimum Deposit

FXCC has removed the barrier to entry. The minimum deposit is $0, though practically speaking, you should start with at least $100 to manage risk effectively.

Payment Methods

FXCC supports a range of modern and traditional payment methods, including the following list.

Withdrawal options |        |

|---|---|

Deposit options |        |

Deposits & Withdrawals: Visa, Mastercard, Bank Wire, Skrill, Neteller, and major Cryptocurrencies (Bitcoin, Ethereum, USDT).

Accepted Countries

FXCC accepts clients resident in many countries around the world. However, due to regulatory restrictions, they do not accept clients resident in the United States, and typically sanctioned jurisdictions.

Deposits and Withdrawals

The process is straightforward, with a good range of modern funding options.

FXCC minimizes costs by absorbing deposits.

What are the key takeaways from the deposit and withdrawal process at FXCC?

- Zero Fees: You keep 100% of your deposit and withdrawal amount (minus any fees your own bank might charge)

- Speed: Digital wallets and crypto are near instant

- Transparency: No hidden processing costs

Is FXCC a Good Broker?

For the cost-focused trader, absolutely.

If you are tired of calculating how much profit you lose to commissions, FXCC’s ECN XL model is a game-changer. It is rare to find a broker that offers genuine 0.0 pip spreads without charging a markup, and this mathematical advantage makes FXCC one of the most efficient execution venues I have reviewed in the last year.

Here is why I rate FXCC highly:

Unbeatable Costs: You get institutional-grade raw spreads (from 0.0 pips) with zero commission. Most competitors charge $7.00 per lot for this privilege.

Hybrid Safety: You get the best of both worlds—Tier-1 security via their CySEC license (for fund safety) and flexible leverage (1:1,000) via their global entities.

No "Gotcha" Fees: There are no inactivity fees, no deposit fees, and no withdrawal fees.

Simplicity: They don't hide their best spreads behind a "VIP" deposit wall. Whether you deposit $100 or $10,000, you get the same ECN conditions.

The Verdict

While beginners might find the educational resources a bit lean compared to big-bank brokers, for the experienced trader who just wants fast execution and zero fees, FXCC is a top-tier choice.

How We Make Money

DailyForex generates revenue by publishing promotional materials from paying brokers and service providers, which has no impact on the objectivity of our reviews. Our mission is to offer clear, accurate, and transparent evaluations of Forex and CFD brokers, using a rigorous, data-driven approach. Our partners may be placed highly within certain areas of the site, but our broker ratings are always based on objective analysis. Find out more here.

FAQs

What is the maximum leverage offered by FXCC?

Clients serviced through the EU branch are limited to 1:30 maximum leverage. Clients serviced through other branches can access maximum leverage up to 1:1,000.

How do you deposit money into FXCC?

You can fund your account using Credit/Debit cards, Bank Wires, Skrill, Neteller, or Crypto.

What is the minimum deposit for FXCC?

The minimum deposit for FXCC is $0 – they have no minimum deposit, ensuring the platform is accessible to everyone.

Is FXCC a regulated broker?

Yes. FXCC holds a Tier-1 license from CySEC (Cyprus) for EU clients and are regulated by the MISA for international accounts.