For over a decade, DailyForex has been the trusted Forex broker authority, establishing an unrivalled reputation for rigorous research and journalistic integrity. With a methodology refined through years of industry experience, we empower traders to make informed decisions, which is particularly important when trading high-risk investments such as penny stocks. Discover more about our comprehensive review process and how we maintain transparency and impartiality here.

Plus500 Editor’s Verdict

Having reviewed Plus500 in detail, I found this commission-free, multi- asset broker to be a strong choice for traders seeking a user friendly, highly regulated trading environment. While the lack of support for algorithmic and copy trading will be a limitation for some users, Plus500 compensates with solid pricing on an extensive list of assets, and an exceptionally smooth user experience. I’d argue that Plus500 is best suited to manual traders who value an intuitive platform with robust risk-management features. It’s also a great option for equity-focused portfolios, offering retail traders one of the most extensive selections of share CFDs and options out there. For US residents, futures trading is offered across a range of asset classes by Plus500 Futures. With 2800+ CFDs, 2700+ shares and a variety of futures across three platforms, it’s no surprise that this reputable broker continues to increase its global market share.

Overview

A leading name in commission-free CFD trading, Plus500 is a publicly listed company that has an extensive global reach with a global client base exceeding 430,000 traders. The broker has a very strong regulatory footprint, plus an excellent reputation for transparency and corporate responsibility, built over almost two decades.

Headquarters | Israel |

|---|---|

Regulators | ASIC, CFTC, CySEC, EFSA, FCA, FMA, FSCA, MAS, NFA, SCA |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2008 |

Execution Type(s) | Market Maker |

Minimum Deposit | $100 (only in UK, Poland, Germany, Bulgaria $50) |

Negative Balance Protection | |

Trading Platform(s) | Proprietary platform, Web-based |

Average Trading Cost EUR/USD | 1.1 pips |

Average Trading Cost GBP/USD | 1.4 pips |

Average Trading Cost WTI Crude Oil | - |

Average Trading Cost Gold | - |

Average Trading Cost Bitcoin | - |

Retail Loss Rate | 79.00% |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | Not applicable |

Minimum Commission for Forex | Commission-free |

Funding Methods | 8+(Visa, Skrill, Bank transfer, Apple Pay, Trustly, iDeal, Postepay) |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

Who Should Trade with Plus500?

Trader Type | Rating | Summary |

Newer Traders | 4.5/5 | A user-friendly platform, an unlimited demo account, and built-in risk management tools (including guaranteed stop-losses) make Plus500 accessible for beginner traders |

Copy Traders | 2/5 | Plus500 does not support copy or social trading, making it unsuitable for this type of trader |

Swing Traders | 4/5 | The wide range of equity CFDs, indices, commodities, and options supports multi-day and position-based strategies |

News Traders | 3.5/5 | Plus500’s fast execution and real-time alerts are highly beneficial around news events, though news traders may require more advanced macroeconomic and third-party research tools |

Automated Traders | 2/5 | A lack of support for MT4, MT5, APIs, and algorithmic trading make Plus500 less suitable for traders implementing for EA-driven or quantitative strategies |

Investors | 3/5 | Share dealing is enabled in select regions, but the core offering is CFD-focused, which is less relevant to long-term buy-and-hold investors |

Day Traders | 4/5 | Commission-free trading and reliable execution make Plus500 a good fit for discretionary day traders |

Scalpers | 3.5/5 | Guaranteed stop-losses provide great trade protection, but variable spreads and the absence of ultra-low-latency infrastructure minimise high-frequency scalping potential |

Plus500 Highlights

- A commission-free pricing model with dynamic spreads

- Access to over 2,800 CFDs, including forex, cryptocurrencies, commodities, indices, equities, ETFs, and options

- Regulation by multiple top authorities (FCA, ASIC, CySEC, MAS, and others) and public listing on the London Stock Exchange (FTSE 250)

- User-friendly proprietary web, desktop, and mobile platforms designed for both beginners and experienced traders

- Free and unlimited demo account access with adjustable for testing strategies risk-free

- Built-in risk management tools, including guaranteed stop-loss orders, real-time alerts, and advanced position controls

- In-depth market insights via the +Insights and +Me tools for analysing market sentiment and personal trades

- A fast registration process with multiple payment methods and a low minimum deposit in key regions

Plus500 Regulation and Security

Plus500 operates through multiple regulated entities worldwide and maintains an excellent compliance record.

How Does Plus500 Regulation Measure Up to the Competition?

At DailyForex, we place significant importance on broker regulation, as it directly impacts fund security, transparency, and trader protection. Brokers regulated by at least one tier-1 authority are typically subject to the highest global standards, including strict capital requirements, client fund segregation, and fair-trading rules.

Country of the Regulator | United Arab Emirates, Australia, Cyprus, Estonia, Israel, New Zealand, Seychelles, Singapore, United Kingdom, South Africa |

|---|---|

Name of the Regulator | ASIC, CFTC, CySEC, EFSA, FCA, FMA, FSCA, MAS, NFA, SCA |

Regulatory License Number | 509909, 250/14, 417727, 486026, 47546, SD039, 100648-1, NOT AVAILABLE, 4.1-1/18, F005651, 20200000232 |

Regulatory Tier | 2 |

Number of Tier 1 Regulators

In the below table, Plus500 is compared to two of its market competitors:

Plus500 | Think Markets | XTB |

|---|---|---|

4 | 3 | 3 |

Since 2018, Plus500 has been publicly listed in the UK and has been a constituent of the FTSE 250 Index, which along with the broker’s strong regulatory oversight makes it a secure choice for retail traders.

Plus500 presents clients with ten well-regulated entities and has maintained an excellent regulatory record. Additionally, all client funds deposited with Plus500’s Cyprus subsidiary are held in segregated client bank accounts in accordance with the Cyprus Security and Exchange Commission’s (CySEC) client funds rules. Equally, Plus500AU Pty Ltd holds client money in a segregated trust account, in accordance with Australian legal requirements.

Plus500 is ideal for active traders, since it remains a well-capitalized broker with a trusted reputation, which is likely to significantly reduce the risks of default or malpractice.

Plus500 Fees

HOW WE TEST BROKER FEES

At DailyForex, we review broker fees by opening live accounts and trading multiple asset classes to assess spreads, commissions, and overall trading costs. We compare each broker’s fees against industry averages for major currency pairs. We also assess deposit, withdrawal, inactivity, and swap fees, rewarding price competitiveness and transparency. Learn more here.

How Do Plus500 Fees Stack Up to Competitors?

Trading costs directly influence on long-term profitability, particularly for active traders. As the most liquid forex instrument, the EUR/USD pair serves as the best benchmark for comparing spreads across brokers. Brokers offering attractive0 EUR/USD pricing, generally tend to provide similar conditions across other major markets.

Average Trading Cost EUR/USD:

In the below table, Plus500 is compared to two of its market competitors:

Plus500 | Think Markets | XTB |

|---|---|---|

1.1 | 1.0 | 1.0 |

Plus500 offers a commission-free pricing model, providing dynamic spreads with no minimums. While trading fees for some asset classes are very competitively priced, such as crude oil CFDs, some index CFDs and select equity CFDs, others are closer to the industry average, making it important for traders to evaluate costs based on their preferred markets.

Plus500 does not charge deposit or withdrawal fees, though third-party payment costs may apply.

Average Trading Cost EUR/USD | 1.1 pips |

|---|---|

Average Trading Cost GBP/USD | 1.4 pips |

Average Trading Cost WTI Crude Oil | - |

Average Trading Cost Gold | - |

Average Trading Cost Bitcoin | - |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | Not applicable |

Minimum Commission for Forex | Commission-free |

Deposit Fee | |

Withdrawal Fee | |

Inactivity Fee | $10 monthly after 3 months |

Overnight Funding Fee

Swap rates apply to overnight positions, and Plus500 pays positive swap rates on certain instruments at certain times, meaning traders can receive a daily fee for holding positions open over the New York rollover. Traders can easily check applicable fees by clicking on the Details link next to the name of the trading instrument in the platform.

Currency Conversion Fee

Plus500 levies a currency conversion fee of up to 0.70% on realized profits and losses. For example, if you have the US Dollar as your account base currency and make trades in Euro-denominated assets, Plus500 will charge a currency conversion fee.

Guaranteed Stop Order Fee

Plus500 enables traders to use guaranteed stop orders to ensure positions close at the price they specify, regardless of market conditions. The broker charges a fee for use of a guaranteed stop order by widening the spread, which is asset dependent.

Inactivity Fee

Plus500 levies a monthly inactivity fee of $10 if traders fail to log into their accounts for three months. I don’t see this as an issue, since this can be easily avoided by checking your account balance every two to three months, even if you are otherwise inactive.

Overnight Funding Fee

Swap rates apply to overnight positions, and Plus500 pays positive swap rates on certain instruments at times, meaning traders can receive a daily fee for holding positions open over the New York rollover. Traders can conveniently check applicable fees by clicking on the Details link next to the name of the trading instrument in the trading platform.

Currency Conversion Fee

Plus500 levies a currency conversion fee of up to 0.70% on realized profits and losses. For example, if you have the US Dollar as your account base currency and make trades in Euro-denominated assets, Plus500 will charge a currency conversion fee.

Guaranteed Stop Order Fee

Traders may use guaranteed stop orders at Plus500, ensuring positions close at the price the trader specifies, irrelevant to market conditions. Plus500 charges a fee for use of a guaranteed stop order by widening the spread on the asset, which is irrevocable, and asset dependent.

Inactivity Fee

Plus500 charges a monthly inactivity fee of $10 if traders fail to log into their accounts for three months. This can be easily avoided by checking your account balance every two to three months if you are otherwise inactive with your trading account.

What Can I Trade on Plus500?

I really appreciate the depth of Plus500’s equity and options offering, which supports more advanced portfolio construction and hedging strategies.

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

I’m a fan of the CFD selection at Plus500, which is extensive. With 2,800 CFD instruments, traders have plenty of trading opportunities and cross-asset diversification. Unlike many competitors who focus on large-cap stocks only, Plus500 also offers traders access to mid-cap names, where risks and rewards remain higher. Equity leverage remains restricted to 1:5, even for highly liquid names.

Plus500 offers as CFDs 71 currency pairs, 19 cryptocurrency pairs, 23 commodities, 34 index CFDs, 1,737 equity CFDs, 105 ETFs, and 877 options contracts. I like the overall breadth of trading instruments, which serves most trading strategies well. The extensive options contracts selection allows traders to deploy more sophisticated trades, and it also serves as a low-cost portfolio hedge. Meanwhile, traders in select countries can use Plus500’s Invest platform for share trading.

When it comes to crypto, in addition to Bitcoin ETFs, Plus500 also offers traders a selection of 8 Ethereum ETFs.

Asset List and Leverage Overview

Currency Pairs | 71 |

|---|---|

Cryptocurrency Pairs | 19 |

Commodities and Metals | 23 |

Index CFDs | 34 |

Equity CFDs | 1,737 |

Bonds | 0 |

ETFs | 97 |

Options, Futures, and Synthetics | 877 |

Maximum Retail Leverage | 1:30 |

Maximum Pro Leverage | 1:300 |

Plus500 Trading Hours (GMT +1 Server Time)

Asset Class | From | To |

|---|---|---|

Currency Pairs | Sunday 23:05 | Friday 22:00 |

Cryptocurrencies | Sunday 15:00 | Sunday 14:00 |

Commodities | Monday 00:00 | Friday 23:00 |

Crude Oil | Monday 00:00 | Friday 23:00 |

Gold | Monday 00:00 | Friday 23:00 |

Metals | Monday 00:00 | Friday 23:00 |

Equity Indices | Monday 09:00 | Friday 22:00 |

Stocks | Monday 09:00 | Friday 22:00 |

ETFs | Monday 15:30 | Friday 22:00 |

Please note that equity markets open and close each trading day, and are not operational continuously, like Forex and cryptocurrencies.

Plus500 traders can access trading hours from their platform by following these steps:

1. Click on the ⓘ symbol of desired assets in the trading platform, located on the far-right in the instrument row.

2. Scroll down until you see the Current trading session and Next trading session.

Plus500 Account Types

I like that Plus500 provides all traders with access to the same trading account type, and in general, doesn’t upsell for better trading conditions based on higher deposits.

However, there are certain jurisdictions, like the UK, Cyprus, and Australia, where Plus500 offers an upgrade to a Pro account.

The minimum deposit is $50, and the maximum leverage depends on the jurisdiction.

Plus500 Demo Account

Plus500 offers free, unlimited demo accounts, with a default balance of $50,000. Once the portfolio drops to $200, Plus500 restores the starting balance.

Plus500 users are now able to self-adjust their demo account balance. This new feature allows users to personalize their trading experience while using the Plus500 demo and better reflect their target volume of investments.

Plus500 Trading Platforms

Every trader has a unique trading style, and platform choice plays a crucial role in execution and analysis. While platforms like MT4, MT5, and cTrader dominate the retail space, proprietary platforms can offer a more streamlined and intuitive experience when well designed.

Plus500 focuses exclusively on its in-house platform, ensuring consistency across web, desktop, and mobile versions. Although it lacks automated and social trading functionalities, it delivers a smooth, stable, and user-friendly trading experience.

Available Trading Platforms

In the below table, Plus500 is compared to two of its market competitors:

Platform | Plus500 | XBT | Think Markets |

|---|---|---|---|

MT4 | X | X | ✓ |

MT5 | X | X | ✓ |

C Trader | X | X | X |

TradingView | X | X | ✓ |

Proprietary | ✓ | ✓ | ✓ |

The Plus500 proprietary platform can be downloaded as a desktop client for Windows 10, but I recommend the lightweight Webtrader, as the functionality remains the same. The platform, which is highly intuitive, is also available as a mobile app.

The Plus500 Webtrader

Designed with both beginners and experienced traders in mind, the Plus500 Webtrader platform offers a tool-rich, user-friendly trading experience. Though copy and algorithmic trading are not supported, traders benefit from multiple sophisticated analytical tools, real-time data, and a broad selection of CFD’s.

The Plus500 App

For traders on the move, the Plus500 mobile app provides direct access to the global markets and an exceptionally easy-to-use trading experience. Packed with smart tools and features it offers all the functionality of the Webtrader for traders on the go. Users get all the tools they need make informed trading decisions, including real-time quotes, dynamic charts, and an extensive array of risk management tools.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Unique Features

Plus500 offers a variety of tools that come in handy in the trade decision-making process. These include push notifications based on market events, alerts on price movements, and changes in its in-house trader sentiment indicator.

‘+Insights’ is a trend exploration tool, which allows users to explore predefined data points such as ‘most bought’, ‘most sold (shorted)’, ‘most profit-making positions’, ‘most loss-making positions’ etc. and get a list of the top 10 instruments for each data point.

‘+Insights’ also lets users filter and focus their exploration, enabling them to gain deeper insights into market trends and support their trading strategy.

+ "Instrument +Insights Tab

The ‘Instrument +Insights Tab’ is an instrument-focused experience that lets users dive a bit deeper into each instrument’s data. Some of the information presented in this tab is based on ‘Plus500’ trading data, like how many views this instrument had in the last 24 hours, or how popular this instrument is across the platform.

Another feature of this tab is crowd source data. Users can access analysis of what the crowd thinks about an asset and compare the subjectivity of this opinion against ‘real-world’ data from news items plus the volume and source of those items.

"+Me"

The +Me tool reflects your trading insights and compares them to those of other real Plus500 traders.

You can use this tool to keep track of what you trade most, and how often you use risk management tools, in comparison to other platform users.

You can also see how many positions you have opened in the last week, exploring how your choice of favourite markets and various other trading preferences compare to those of other Plus500 traders.

Research and Education

Plus500 provides a solid selection of market commentary in its “News & Insights” section, plus a series of introductory educational videos, complemented by written content. The Plus500 Trading Academy offers a variety of educational products including an eBook, video traders’ guide, and FAQs, as well as webinars, which are accessible to premium users.

While Plus500 does not offer tradable research, its proprietary +Insights tools provide valuable sentiment and trend data derived from internal trading activity.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/7 |

Website Languages |                    |

Plus500 relies on its FAQ section to answer most questions, though 24/7 live support is also available, embedded with the trading platform, which I recommend for any queries.

Plus500 traders can reach the support team via email, live chat, or WhatsApp, and since the broker explains its products and services well, ensuring smooth operations, the current available channels are more than satisfactory.

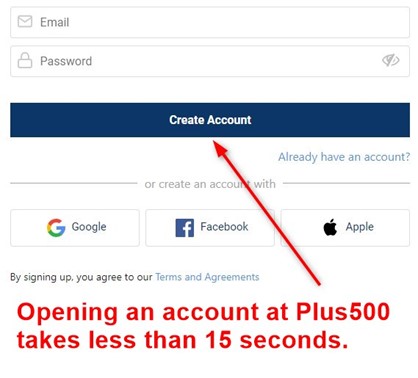

Plus500 Opening an Account

Opening an account at Plus500 takes less than 15 seconds. Traders must submit their email and select their password. They may also use their Google, Facebook, or Apple accounts to register with the broker. Account verification is mandatory, which for most traders can be completed by sending a copy of their ID and one proof of residency document.

Plus500 Minimum Deposit

The minimum deposit at Plus500 is $50, which is higher than some brokers but within a reasonable range.

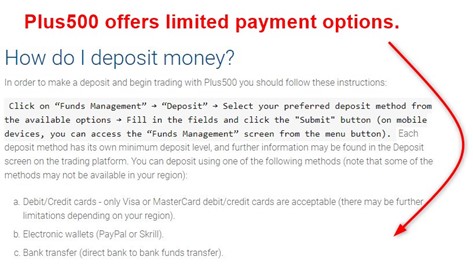

Payment Methods

Plus500 payment methods are:

Withdrawal options |       |

|---|---|

Deposit options |       |

Plus500 Accepted Countries

Plus500 caters to most international traders, including the UK, Australia, South Africa, New Zealand, Netherlands, Spain, Italy, Cyprus, Bulgaria, Czech Republic, Denmark, Estonia, Greece, Latvia, Malta, Poland, Indonesia, Singapore, Israel, Argentina, Chile, Bahrain, Hong Kong, UAE.

Plus500 offers Plus500 Futures, a dedicated brand for US residents and US persons abroad, which provides trading in a wide range of futures and options contracts.

Deposits and Withdrawals

Plus500 does not charge deposit or withdrawal fees but applies a currency conversion fee of 0.70% where relevant. Third-party payment processor costs also exist, and I recommend traders check them in advance. To minimize costs, traders should try to avoid small or frequent withdrawals.

Plus500 internal processing times for withdrawals range between one and three business days, while external processing times depend on the desired payment option. However, it’s worth noting that the FAQ section lists lengthy timeframes even for comparatively fast online payment services.

The minimum deposit is only $50 in the UK, Germany, Poland and Bulgaria, but everywhere else, it is $100.

Bottom Line

Plus500 delivers a reliable and well-regulated trading environment that is tailor-made for manual CFD traders. Its broad asset coverage, and intuitive platform make it the ideal broker for equity-focused and medium-term traders.

- Strong global regulation and public listing

- An excellent selection of equities and options

- An easy-to-use proprietary platform

- Guaranteed stop-loss protection

- No automated or copy trading

In my view, Plus500 stands out as a trustworthy, competitive broker, which is particularly suited for traders prioritizing simplicity, regulation, and a broad selection of tradable assets.

How We Make Money

DailyForex generates revenue by publishing promotional materials from paying brokers and service providers, which has no impact on the objectivity of our reviews. Our mission is to offer clear, accurate, and transparent evaluations of Forex and CFD brokers, using a rigorous, data-driven approach. Our partners may be placed highly within certain areas of the site, but our broker ratings are always based on objective analysis. Find out more here.

FAQs

Does Plus500 offer real money accounts?

While Plus500 offers demo accounts with a virtual balance of $50,000, it also offers trading with real money accounts. Depending on the success of your trading strategies, over any given time-frame, the real money account may or may not earn real money profit.

Is Plus500 a good option in Australia?

Plus500 operates an Australian subsidiary with ASIC oversight. Plus500AU Pty Ltd holds client money in a segregated trust account, in accordance with Australian legal requirementsand is a good CFD broker for manual traders.

Can Plus500 be trusted?

Plus500 operates through multiple well-regulated global entities and has maintained an excellent compliance record. Since 2018, the broker has been publicly listed in the UK and has been a constituent of the FTSE 250 Index. It is also well-capitalized, with a trusted reputation, which along with the broker’s strong regulatory oversight makes it a secure choice for retail traders.