Trump kicked off yesterday’s speech at the World Economic Forum in Davos, Switzerland, by talking about how great he is and how the US is the ‘hottest’ country in the world, with expectations for future growth. Essentially, the first 30 minutes represented a retrospective celebration of how terrific his first year in office has been.

The speech traversed a wide rhetorical landscape, from calling windfarm purchasers ‘stupid people’ and declaring Denmark ungrateful for declining to hand over Greenland. He also found time to comment on French President Emmanuel Macron's sunglasses – to which I have to say was difficult to dispute – and belittle Switzerland as ‘only good because of us’. Trump specifically targeted UK Prime Minister Sir Keir Starmer's position on North Sea oil and gas, asserting that the UK government's policies hinder the development of vast reserves, thereby driving up energy costs.

Importantly, though, Trump has pulled back on his proposed European 10% levies set to come into effect on 1 February and noted that the US will not take Greenland by force; both clarifications were meaningful and helped calm markets.

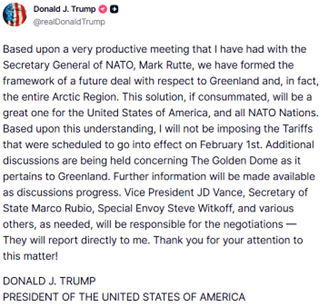

The pullback on EU tariffs hinges on a ‘framework of a future deal with respect to Greenland’, as per the President’s recent Truth Social post. While the temperature around Greenland has cooled following Trump’s speech yesterday, I feel it is far from resolved, and the next few days could prove interesting.

Market response

In terms of where we are in the markets this morning, US Stock benchmarks ended Wednesday on a strong footing, echoing relief over the tariff reprieve for the eight European nations initially targeted. The S&P 500 advanced 78 points (1.2%) to 6,875, the Nasdaq 100 added 339 points (1.4%) to 25,326, with the Dow Jones climbing 588 points (1.2%) to 49,077. Both European and US equity index futures are also pointing to higher markets at respective cash opens this morning.

From Tokyo, JGB yields eased from their record highs across longer-dated bonds, further calming market nerves. The USD/JPY, however, continues to fluctuate around ¥158.00, largely undeterred by recent verbal intervention. USD/JPY resistance remains in play at current levels, with a break north potentially unearthing a move to as far as ¥160.00. The question is whether the BoJ intervenes in this region.

Also noteworthy is that the risk-on rally and positive December jobs data from Australia aided a solid bid in the AUD this morning versus G10 peers. Unemployment cooled to 4.1% from 4.3% in November, with about 65,000 new jobs created versus around 30,000 forecasted. Along with a robust rally in the AUD overnight, a hawkish repricing in the RBA cash rate unfolded, suggesting a 60% probability for a hike at next month’s meeting.

Day ahead will focus on US PCE numbers

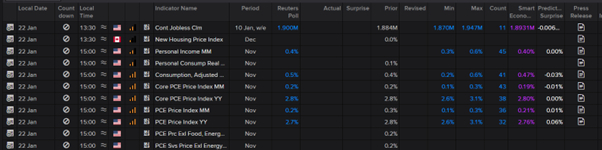

While attention will remain on discussions regarding Greenland, and with Aussie jobs data in the rear-view mirror, today’s macro focus is on the final estimate for Q3 25 US GDP at 1:30 pm GMT, initial jobless claims for the week ending 17 January also at 1:30 pm, and the November PCE inflation numbers at 3:00 pm. Additionally, the Q4 25 New Zealand CPI inflation figures will land later at 9:45 pm.

Ultimately, I believe that the PCE report will dominate the headlines today. As shown from the LSEG economic calendar below, price pressures are expected to remain steady at 2.8% for the YY core measure, while decelerating modestly for the headline YY print at 2.7% (from 2.8% in October). This is a pace I would describe as sticky and reinforces the Fed’s wait-and-see stance to ease policy. Note that the Fed projects only one rate cut this year, while markets are still betting on two, with the first expected either in June or July’s meeting, with another likely in Q4. Of course, an upside surprise in the inflation data today – I would want to see around 2.9% or 3.0% – would likely trigger a USD bid as traders potentially price out some of the Fed rate-cut easing. Conversely, anything around the 2.6% mark today would have the opposite effect and bring April’s meeting firmly to the table for the first rate cut.

Written by FP Markets Chief Market Analyst Aaron Hill