Long Trade Idea

Enter your long position between $115.53 (yesterday’s intra-day low) and $121.21 (yesterday’s intra-day high).

Market Index Analysis

- Atlassian (TEAM) is a member of the NASDAQ 100 Index.

- This index sold off amid fresh tariffs and risks of reigniting trade and capital wars.

- The Bull Bear Power Indicator of the NASDAQ 100 Index is bearish with a descending trendline.

Market Sentiment Analysis

Equity markets sold off heavily yesterday amid escalating geopolitical tensions, especially over Greenland, after President Trump doubled down on his quest to acquire the island. He continues to lash out at NATO allies, with the UK its latest target. Risks of reigniting a US-Euro trade war, with the added risks of a capital war, have triggered the sell-off. Still, most investors are likely to brush aside geopolitics and focus on earnings after 3M disappointed, Netflix slid, but futures point towards a rebound this morning. Johnson & Johnson, Charles Schwab, and mid-sized financial institutions will report earnings today.

Atlassian Fundamental Analysis

Atlassian is a proprietary software company specializing in collaboration tools for software development and project management. It employs over 12,000 people in 14 countries and serves more than 300,000 customers across 200 countries.

So, why am I bullish on TEAM despite its massive correction?

I turned bullish on Atlassian after valuations came down, and the 5-Year PEG ratio suggests it is undervalued. Atlassian’s Rovo initiative, which is free to accelerate adoption, has reached 3.5 million monthly active users, boasts an impressive 50% quarter-over-quarter growth rate, and is expected to generate $400–$600 million in Cloud ARR by 2027. Its enterprise segment, Teamwork Collection, gains traction, and its forward price-to-sales ratio is well below the industry average.

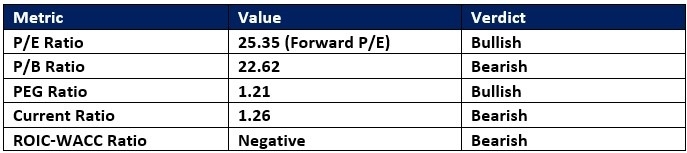

Atlassian Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio is unavailable, but the forward P/E ratio of 25.35 makes TEAM an inexpensive stock. By comparison, the P/E ratio for the NASDAQ 100 is 37.76.

The average analyst price target for TEAM is $236.08. This suggests excellent upside potential with decreasing downside risks.

Atlassian Technical Analysis

Today’s TEAM Signal

Atlassian Price Chart

- The TEAM D1 chart shows price action inside a triangle formation.

- It also shows price action between its descending 0.0% and 38.2% Fibonacci Retracement Fan levels.

- The Bull Bear Power Indicator is excessively bearish, hinting at a capitulation sell-off.

- The average bearish trading volumes spiked during the previous week, suggesting downside exhaustion could set in, with heavy bullish trading volumes yesterday.

- TEAM corrected more than the NASDAQ 100, a bearish confirmation, but bullish catalysts have started to accumulate.

My TEAM Long Stock Trade

- TEAM Entry Level: Between $115.53 and $121.21

- TEAM Take Profit: Between $163.92 and $176.72

- TEAM Stop Loss: Between $98.78 and $103.98

- Risk/Reward Ratio: 2.89

Ready to trade our analysis of Atlassian? Here is our list of the best stock brokers worth reviewing.