Long Trade Idea

Enter your long position between $23.19 (the lower band of its horizontal support zone) and $23.60 (yesterday’s intraday high).

Market Index Analysis

- AT&T (T) is a member of the S&P 100 and the S&P 500.

- These indices sold off amid fresh tariffs and risks of reigniting trade and capital wars.

- The Bull Bear Power Indicator of the S&P 500 is bearish with a descending trendline.

Market Sentiment Analysis

Equity markets sold off heavily yesterday amid escalating geopolitical tensions, especially over Greenland, after President Trump doubled down on his quest to acquire the island. He continues to lash out at NATO allies, with the UK its latest target. Risks of reigniting a US-Euro trade war, with the added risks of a capital war, have triggered the sell-off. Still, most investors are likely to brush aside geopolitics and focus on earnings after 3M disappointed, Netflix slid, but futures point towards a rebound this morning. Johnson & Johnson, Charles Schwab, and mid-sized financial institutions will report earnings today.

AT&T Fundamental Analysis

AT&T is a telecommunications holding company. It is also the third-largest telecom company by revenue globally and the third-largest mobile company in the US.

So, why am I bullish on T despite its correction?

I am bullish on its low valuations, defensive portfolio characteristics, and ongoing strategic spectrum acquisitions, as well as 5G and fiber-optics expansions. Operating margins are rising, and I am cautiously optimistic about next week’s earnings release. The $5.75 billion acquisition of Lumen’s fiber assets positions AT&T to capture BEAD program funding and grow high-margin broadband revenue. Its $20 billion share repurchase program and 4.6% dividend yield compensate investors well for short-term volatility.

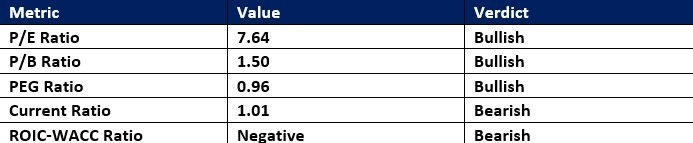

AT&T Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 7.64 makes T an inexpensive stock. By comparison, the P/E ratio for the S&P 500 is 30.69.

The average analyst price target for T is $29.48. It suggests good upside potential with acceptable downside risks.

AT&T Technical Analysis

Today’s T Signal

AT&T Price Chart

- The T D1 chart shows price action inside a horizontal support zone.

- It also shows price action between its descending 0.0% and 38.2% Fibonacci Retracement Fan levels.

- The Bull Bear Power Indicator turned bearish but remains near its ascending trendline.

- Bullish trading volumes outpace average bearish volumes over the past week.

- T corrected more than the S&P 500 Index, a bearish development, but bullish catalysts continue to accumulate.

My T Long Stock Trade

- T Entry Level: Between $23.19 and $23.60

- T Take Profit: Between $29.48 and $30.36

- T Stop Loss: Between $21.05 and $21.68

- Risk/Reward Ratio: 2.94

Ready to trade our analysis of AT&T? Here is our list of the best stock brokers worth reviewing.