Long Trade Idea

Enter your long position between $145.61 (the lower band of its horizontal support zone) and $156.50 (the upper band of its horizontal support zone).

Market Index Analysis

- Paycom Software (PAYC) is a member of the S&P 500 Index.

- This index is retreating from its all-time highs with rising bearish catalysts.

- The Bull Bear Power Indicator of the S&P 500 is bearish with a descending trendline.

Market Sentiment Analysis

Equity markets rebounded after a bearish start to the session, as investors welcomed President Trump’s announcement that he will not use force to acquire Greenland. Futures are rising this morning, but are off their highs, and the focus will shift to earnings season, where expectations are sky-high. A recent Bloomberg report noted that beating estimates has the lowest impact on stocks on record. Today’s calendar features releases by Intel, Procter & Gamble, and GE Aerospace.

Paycom Software Fundamental Analysis

Paycom Software is an online payroll and human resources software company. It caters to customers in 190 countries in 15 dialects. Its core software products include Beti, Global HCM, GONE, and IWant. The latest addition is a command-driven AI engine for employee data searches, but it is more hype than a breakthrough in HR management.

So, why am I bullish on PAYC despite its 45%+ sell-off?

Valuations dropped to attractive levels, and institutional buying should provide a floor under the current sell-off. The acceleration of HR AI tools and single-database HCM solutions is picking up, and I am cautiously bullish about its fourth-quarter earnings release after it beat expectations in the third quarter. Free cash flow growth is surging, supporting its R&D investments, which I believe will drive revenue growth. I also view shares as extremely undervalued at current levels.

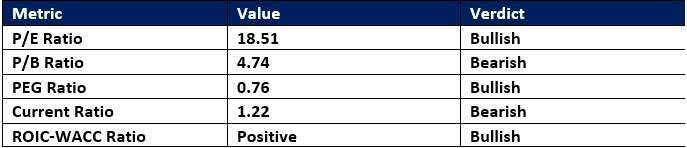

Paycom Software Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 18.51 makes PAYC an inexpensive stock. By comparison, the P/E ratio for the S&P 500 is 31.05.

The average analyst price target for PAYC is $203.35. It suggests excellent upside potential with decreasing downside risks.

Paycom Software Technical Analysis

Today’s PAYC Signal

Paycom Price Chart

- The PAYC D1 chart shows price action inside a horizontal support zone.

- It also shows price action between its descending 0.0% and 38.2% Fibonacci Retracement Fan levels.

- The Bull Bear Power Indicator is bearish but close to its ascending trendline.

- Over the past few trading sessions, the average trading volumes have been higher during bullish days than during bearish days.

- PAYC corrected less than the S&P 500, a bullish trading signal.

My PAYC Long Stock Trade

- PAYC Entry Level: Between $145.61 and $156.50

- PAYC Take Profit: Between $188.08 and $198.20

- PAYC Stop Loss: Between $128.55 and $132.53

- Risk/Reward Ratio: 2.49

Ready to trade our analysis of Paycom? Here is our list of the best stock brokers worth checking out.